Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Updated 5th April 2024

Your credit record could be affecting your ability to get a loan, credit card, mortgage, or even bank account. If you’ve been struggling to get mobile phone contracts, loans, credit cards or any other kind of borrowing, you might need to clean up your credit record.

Here’s how to find out if your rejections for credit applications are caused by a marked credit report – and how to rectify the issue.

The first thing you should do to clean up your credit record is register with the credit report agencies – Experian, TransUnion (formerly CallCredit) or Equifax. It’s free to request your credit report from all three providers.

You might very well know why no one will lend to you. Perhaps:

It will take a while to clean up your credit record with these types of judgements against your finances, but all is not lost. Regular repayments of any credit you do have, along with sensible expenditure within your means, can slowly make a difference.

It’s still worth getting your free credit report from the three agencies even if you know why you’re struggling to get credit. There may be other errors or old defaults that you aren’t aware of, which will affect your credit score too.

Checking your credit record lets you correct any mistakes or anything you think isn’t an accurate reflection of your overall financial situation.

The higher your credit score, the better are your chances of being lent money.

The trouble is, that means you have to already have credit and be good at using it (by using a reasonable amount of your available credit and repaying bills in full) to get more.

To remove some of the mystery surrounding credit scoring, Experian have revealed to us their ‘credit scoring test’ system.

It’s worth having a look at it even if you’re looking at your report through another company – theirs will be similar.

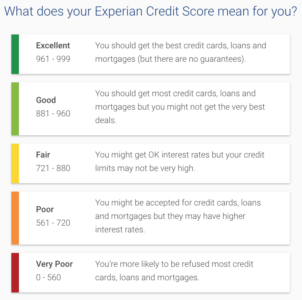

Different credit agencies have different levels of ‘good’ and ‘bad’ scores. That’s why it’s important to check all three agencies.

The Experian Credit Score runs from 0 to 999 and is an indication of how a lender may see you based on the information in your Credit Report. The higher your score, the greater chance you have of getting the best credit deals.

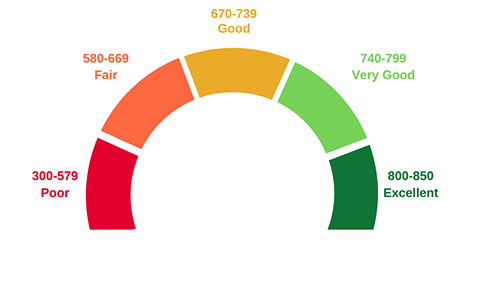

The Equifax credit score goes up to 850.

Poor = 300 – 579

Fair = 580 – 669

Good = 670 – 739

Very good = 740 – 799

Excellent = 800 – 50

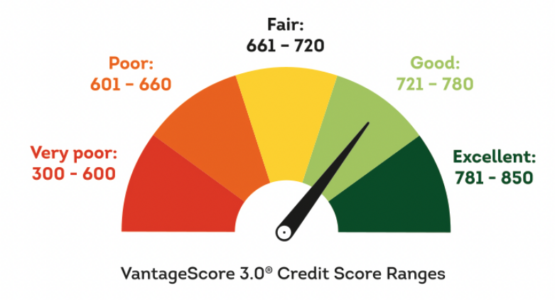

And finally, the Transunion credit score thresholds:

Very Poor = 300 – 600

Poor = 601 – 660

Fair = 661 – 720

Good = 721 – 780

Excellent = 781 – 850

So, if you have a credit score of 700, you might be deemed to have a ‘poor’ score through Experian, ‘good’ for Equifax, or ‘fair’ for Transunion. They each score factors differently, so bear in mind that a 700 score for one may not be 700 on another. However, this comparison should demonstrate why you need to check all three reference agencies when you’re trying to clean up your credit record.

You can also see how much the amount varies between bands, too. For example, for the Transunion boundaries, there are 300 points in the Very Poor range, and only 59 points in the Good range – so as your credit score starts to increase, it will seem like it increases faster the better it gets, as it takes less time to cross the boundary threshold.

Rebuilding your credit score doesn’t happen overnight. In fact, it takes at least six months – probably more like a year – to get a better credit score. If you’ve had a serious blow to your finances, such as a lot of defaults, CCJs, or bankruptcy, it can take years to fully recoup the damage to your credit score. Starting today is the best way to improve your score as quickly as possible!

Lenders look for proof that you’re capable of repaying borrowed money. “But how can I borrow if no one will lend to me?!” you wail. You do it by using one of the credit cards with very high interest rates. These exist especially for people with poor credit ratings. Then you pay the debt before the interest period kicks in. In other words, take out a credit card with a very high APR (Annual Percentage Rate), use it a small amount every month and then pay the bill every month during the interest-free period. There are a few companies that offer credit cards to people with poor credit records.

There are a few cards on the market now that are specifically for people who have no credit history or a bad credit history.

These rebuilder cards are useful for people who want to start repairing their credit score, but as that makes them risky customers in the eyes of lenders, the interest fees can be astronomical. You’ll be fine if you can pay off your usage every month in full – interest only starts to apply if you don’t pay it off each statement month.

You can use online eligibility checkers on each provider’s website to see if you might be accepted. Be careful – make sure you’re using a ‘soft search’ tool and NOT a credit check or application! A ‘soft search’ won’t affect your credit rating if you’re not eligible.

You can also call the providers to ask them to do the same. Some people, such as those with previous IVAs or bankruptcy, may not be eligible for these poor credit cards.

Vanquis (part of Provident Financial which specialises in the ‘sub-prime’ market) does a Vanquis Rebuilder Card with a typical 29.5% interest. It’s specifically aimed at people with a bad credit history (or no credit history) who can’t get other cards. Your credit limit will be between £500 – £1500 to start with, and this can grow to a maximum of £4,000 over time.

The Aqua Reward Card has an average APR of 39.4% and a starting credit limit of £250 – £1500. Aqua have been known to suddenly decrease customer credit limits without notice, which can seriously impact your credit score that you’ve worked hard to recover, so it may be worth looking at other options first. They do, however, have a strong acceptance rate for those with no credit history or a really bad history (such as bankruptcy).

Marbles is run by NewDay, which also does the Aqua card. It offers a simple credit rebuilder card with a typical APR of 34.9% and a credit limit between £250 – £1,500. You can pay online or through the app to help keep track of your spending, too.

If you’ve recently been rejected for a lot of credit cards or bank accounts, it could be that your score is too low for any provider to take a risk on you.

Don’t panic! There are some simple things you can do to start rebuilding trust in your credit score.

Most banks now offer a basic bank account. These have no overdraft facility or monthly account fees. If you’ve been made bankrupt or can’t get another type of bank account, this will start you on the journey to rebuilding your credit score. Make sure you never go overdrawn though – you’ll face hefty fees and damage your credit.

The Money Advice Service has great information about basic bank accounts to get you started.

LoqBox is essentially a loan to help you rebuild your credit. You choose an amount you KNOW you can repay each month – say £20 – and you’ll get a ‘loan’ of 12 months’ worth of that much.

This gets ‘locked’ into an account – you can’t spend the loan – and you pay off your £20 each month as promised. At the end of it, you get your money (which is essentially your savings) ‘unlocked’ – and LoqBox confirms to credit agencies that you have successfully paid back a loan.

It’s a totally free service, too – unlike some other similar ‘credit repayment’ cards. You also won’t need a credit check to apply. Your money is safe: it’s paid into a partner bank that’s covered by the Financial Services Compensation Scheme.

Loqbox is also one of the few services that let you rebuild your credit score with your rent. When you connect your bank account and let them know the date and amount of your rent payment, it keeps track and reports your rental repayments to credit agencies like Experian.

Get a Help to Save Account

If you’re on Universal Credit, you could be eligible for a Help to Save account. While this won’t clean up your credit record, it will be a way to build a nest egg while you’re getting back on financial track. Read our article about it here.

From CreditKarma to Experian to ClearScore, there are now several ways you can stay alert of your credit score for free. Sign up to these services to receive alerts to any changes in your score – and monthly or weekly report updates, too. You can pay for some premium features, but the free versions are usually enough to keep track of your credit rating.

REALLY INTERESTING INFORMATION!!!

KIND REGARDS,

TEODORA

21.4.2023

SOFIA

Informative article.

vary good

I found this helpful

I am going to raise awareness for this, I worked for a major credit reporting agency and you won’t believe how many Americans are affected by poor credit, and how simply they can help their own situation. Do you not watch the news? People think that the banks are on their side, but in fact they’re trying to keep credit scores low so they make more from interest payments –