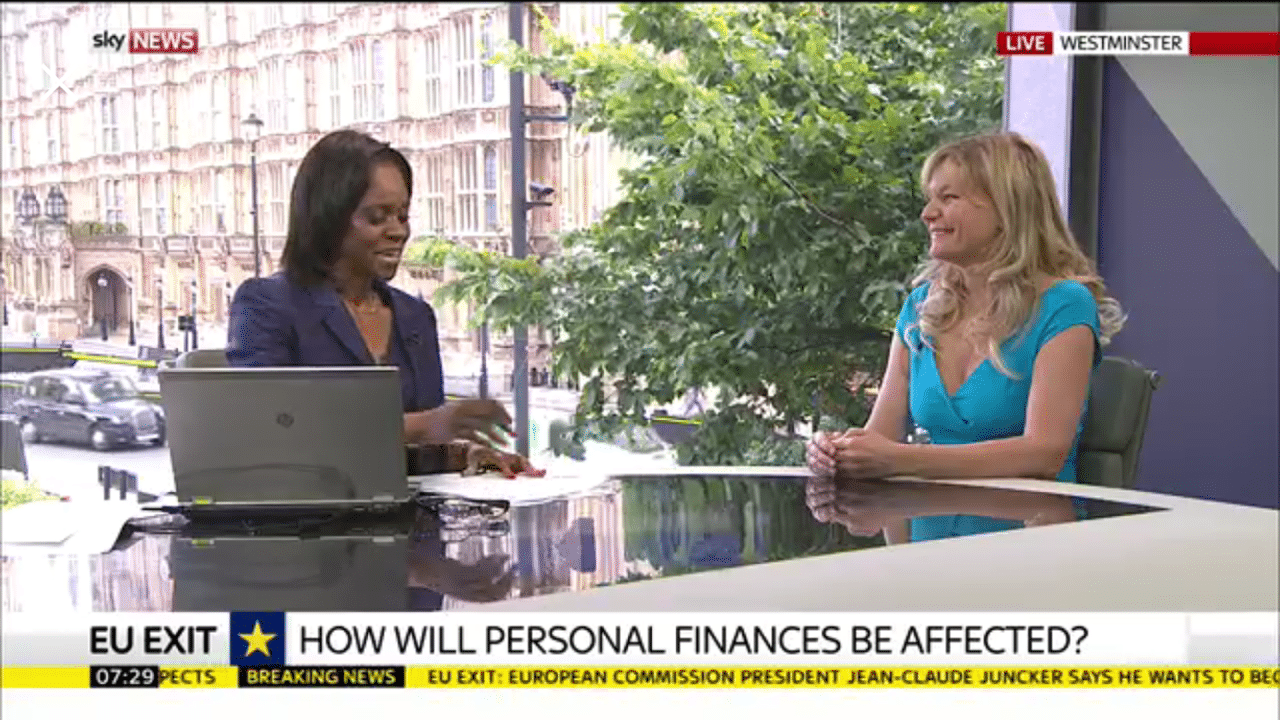

Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

In the past few days you’ve been asking “how does Brexit affect me?”

In particular I’m being asked “how does Brexit affect my money?” In fact I’ve been on most of the TV channels and a load of radio stations answering questions about interest rates, prices, savings, pensions, mortgages and jobs among other things.

No one knows what’s going to happen even in the short-term, let alone the long-term, and things are changing on an hourly basis as well as a daily basis. However, there are some knows in the short-term and some educated guesses that I can give you.

No one knows what’s going to happen even in the short-term, let alone the long-term, and things are changing on an hourly basis as well as a daily basis. However, there are some knows in the short-term and some educated guesses that I can give you.

Facts will change in the weeks and months to come so I’ll be updating this article as and when we get new information so keep checking back.

Also, if you have other questions connected to the question “how does Brexit affect me” then put them in a comment at the bottom of this article. I’ll answer any that you send in.

So, here is a list of the most common questions I’ve had with the best answers I can come up with.

Many of them will yes.

The first to go up will be petrol prices. This is because Sterling (the pound) has dropped significantly against the dollar and is likely (only likely – not definitely) to stay low for a while. As oil is priced in dollars this means that petrol will be more expensive for us to import and that will be reflected at the pumps. They say the price increase is likely to show by the end of the week.

The first to go up will be petrol prices. This is because Sterling (the pound) has dropped significantly against the dollar and is likely (only likely – not definitely) to stay low for a while. As oil is priced in dollars this means that petrol will be more expensive for us to import and that will be reflected at the pumps. They say the price increase is likely to show by the end of the week.

Petrol affects everything that needs to be transported so that alone will potentially add a few pence on the price of other items too. But then, as we in the UK are net importers of goods (in other words, we buy more things from abroad than we do from the UK), while the pound is low against other currencies (and that’s likely to be for a while) it will mean that products we import will be more expensive. That will cover all sorts of things from food to clothes to gadgets and more.

However, as the Euro has been badly affected by our actions as well, the goods we buy from the Eurozone may not be as expensive as we think. It’s just items we buy from other parts of the world that are likely to cost more.

If (and this is unlikely) Sterling does better because of Brexit, then prices should gradually come down.

As prices are likely to go up, at least in the short-term, that means that the rate of inflation will rise (inflation is the cost of living going up).

As prices are likely to go up, at least in the short-term, that means that the rate of inflation will rise (inflation is the cost of living going up).

Usually, when inflation goes up, the way to combat it is to put interest rates up. That’s certainly what was warned of before the Referendum.

However, because the economy is in such turmoil, and is likely to be for a few months to come at least, it’s more likely that the Bank of England will put rates down or keep them as they are. This is because they want to get people and businesses borrowing more.

So this means that it could actually be cheaper to borrow money soon, although it won’t be good for savers, as usual.

If, as I’ve suggested above, interest rates go down then this could mean that we have some very cheap mortgages on the market.

If, as I’ve suggested above, interest rates go down then this could mean that we have some very cheap mortgages on the market.

However, this isn’t necessarily going to mean that anyone who wants a cheap mortgage will be able to get one.

It will probably be better for people remortgaging than new buyers because lenders will be very cautious about who they lend to. They will be happier to lend to people with a lot of equity in their homes and jobs that look stable. While the economy is turbulent they will need to keep big cash reserves and make sure that they only lend to people who are highly likely to pay the money back. This means that some people – particularly those with a small deposit and on an uncertain income – could find it difficult to borrow for a while.

In the short-term at least they are likely to go down.

In the short-term at least they are likely to go down.

When the economy and jobs are uncertain, people tend to put off making big financial decisions. Buying a home is probably the biggest financial decision most of us make so no one will want to rush into doing it. People will tend to put it off and wait to see what happens with the economy, with mortgages and with their jobs.

So in the short-term, that will bring prices down.

However, if mortgages do get cheaper and if it’s not too difficult for people to get them then prices might rise later on.

I f interest rates go down, as I suggested above, then the savings rates will go down even further.

f interest rates go down, as I suggested above, then the savings rates will go down even further.

It has been suggested by some that we might even go into negative interest rates by next year (some countries like Switzerland, Denmark and Sweden already have these) but Mark Carney, the head of the Bank of England, is known to dislike this idea. Still, he may be forced to do it just to keep money circulating around the economy.

If this happens then we could find ourselves in the crazy position of paying the banks to hold our money!

When it comes to the £75,000 compensation limit that the Financial Services Compensation Scheme (FSCS) offers for your savings, that will continue whether we are in or out of the EU. So if the bank or building society in which you have your savings fails you will get the first £75,000 back.

Possibly.

The State Pension is not connected to the EU so it will continue whether we stay in it or leave.

The State Pension is not connected to the EU so it will continue whether we stay in it or leave.

However, the ‘triple lock’ that was set by the Government earlier this year could be affected if our economy does badly in the next few years.

The ‘triple lock’ means that the new Basic State Pension is increased each April by at least 2.5% or even higher. If the economy is too weak to bear this then it’s possible that a future Government will have to drop it.

The stock market volatility isn’t helping pension or other funds that are largely invested in stocks and shares. It’s likely that right now a lot of these funds have lost money because of the dips in the market. However, the stock market can go up as well as down and it’s quite possible that it could rally and even do much better later on. It all depends on how the economy goes, how strong and wise the new leaders seem to be and how confident world investors are in the future of our country.

Also, some investors are seeing this as a ‘buy’ opportunity, buying up stocks that have dipped significantly (like banks and building companies) as they expect many of them to bounce back once things settle down. It may be that the people running your funds are doing this and could make some money at it down the line.

if you’re about to choose an annuity because you’re coming up to retirement you might like to put if off for a bit (in fact consider putting off retirement for a bit until the dust settles). Bond yields are low because so many investors are moving their money from the stock market into bonds and gilts (loans to the Government), and this means that annuities are struggling.

Probably.

Probably.

With the falling pound, if you’re going abroad for your holiday it’s likely that your money won’t go so far, particularly if you’re going to America.

As it happens, at the moment at least, the Euro has dropped as well as Sterling because of what we have done, so the difference between what you can get in the Eurozone now and what you could get before the Referendum isn’t as great as one would expect. It will still be a bit more expensive if you’re going to France or Spain for your holiday but it’s not as bad as it might have been.

Easyjet has said they will have to put their prices up because of fallout from Brexit and other airlines are watching things closely.

it’s never worth worrying about investments and I certainly wouldn’t pull your money out of anything right now – not until the dust settles (probably in a few months’ time) and we can see things a bit clearer.

it’s never worth worrying about investments and I certainly wouldn’t pull your money out of anything right now – not until the dust settles (probably in a few months’ time) and we can see things a bit clearer.

It’s always a good idea to have your investment money in a range of different products (pension, stock market, property, savings accounts etc) so that if one of them does badly, you can rely on the others. It’s also a good idea to give things time to adjust. So don’t pull your money out of anything in a panic. Now is not a time to do anything precipitous. Give it a few weeks at least, probably a few months would be better, to see how things are doing and make an informed decision.

I hope so.

I hope so.

Of course a lot of jobs will stay. In any country situation there are things that have to be done and people that have to do them. However there are some areas such as financial markets and possibly some manufacturing sectors that might suffer because the companies decide they want to move operations to an EU country.

At the same time, though, there may be others that decide to set up in the country because they feel there will be fewer restrictions and perhaps a better tax regime once we are out of the EU.

It’s likely that a number of companies will hold off on hiring people until they know what’s going to happen to the economy so if you’re looking for a job now it might be a bit harder for a while than it would have been before the Referendum.

It’s pretty much a done deal.

The Referendum was not a legally-binding decision. In the end it’s up to Parliament to make the final decision and enact Article 50 which will set in motion our long exit from the EU.

However, the fact that the country has voted, by a majority of 4%, to leave the EU means that Parliament is likely to accept ‘the will of the people’ and vote to leave, even though the majority of MPs believe it is wiser to stay.

There is a popular petition online that is calling for a second referendum, based on the fact that many people who voted to leave said they had regretted the decision and felt they had been lied to about what it would actually mean. If you want to sign it too it is here.

Even if this is discussed in Parliament – as it has to be now that it has had so many signatories – it’s likely that the only thing that would reverse the decision would be a General Election in which the party that won did so with a declaration that they intended to hold another referendum.

The political problems that the parties are dealing with could delay a General Election for months. In the meantime the heads of the EU are demanding that we press the red button right now. It’s a very fraught situation, particularly as neither the Government nor the people running the Leave campaign came up with any post-Referendum plan if people actually voted for Brexit. They seem to be making it up as they go along.

Even Michael Gove’s wife, Sarah Vine, has made a plea for experts to help with the Brexit process, something that has been mocked by many given that her husband said several times before the Referendum that the country was ‘sick of experts’.

i will be updating this article as and when things change or actual hard facts emerge! Keep checking back to see what’s happening and if there’s something you need to know that I haven’t covered here, just ask in the comments below.

Thanks!

Love, Jasmine

i am from latvia and have been in uk for 5 years now do i have to do anything before brexit happens

There are some instructions here https://www.bbc.co.uk/news/uk-politics-44553225 In theory, at least, it shouldn’t be too difficult. Basically you have to give three main pieces of information in order to have leave to stay. However, if you have any difficulties with this, do let us know and we will look into it for you 🙂

Having lived & worked in The Netherlands for 25 years, I have now returned to live in the UK. I have a Dutch State Pension and a Dutch Occupational Pension; both of which are paid monthly into my Dutch bank account. I transfer money to my UK bank account when the rates are most favourable. Will I be able to keep my Dutch bank account as a non-EU citizen and, if not, how will this affect the payment of my Dutch pensions?

Hi Heather,

This all depends on what is agreed in the Brexit negotiations (if they happen). It may get harder for you to have a bank account in the Netherlands but I doubt if they will stop you having one altogether. As for your Dutch pension, I assume that that will continue but they might negotiate a different way to pay it to you.

Sorry, it’s all so uncertain at the moment. No one really knows until the negotiations are started.