Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Are you 45-60 years-old?

Do you work, or would you like to be working?

Are you sitting on a nice pile of savings that will see you through your golden years and give you happy holidays two or three times a year? Or are you worried that you might not have enough to retire at all?

Are you worried that you might lose your job soon, because of your age, and you won’t be able to find more work?

These are issues that people in mid-life often worry about, but the questions seem too big to think about all in one go – so they don’t do it. Instead, they drift from one year to the next, not knowing how to fund their futures.

Don’t let this be you. Give yourself a mid-life MOT.

If you are 45-60, you won’t be surprised to know that you’re in the group of people who are the most stressed in the UK. People in this age group often support their own needs together with those of their children (particularly during lockdown) and older parents who are living longer.

Also, those aged 45-60 will be the first generation to enter retirement without a final salary pension. They’re also the first generation to deal with pension freedoms where we can access our personal and company pensions at age 55 (that’s rising to 57 in 2028).

The good thing is that we can expect to live longer than people did in earlier years. But, as we expect to live longer, we need more money to fund our retirements. We either do this by saving and investing more while we are working, or we work for longer so that we can pay for ourselves and save for longer to fund a later retirement.

So, where are you on your life’s journey? And, more pertinently, how much do you have stashed away for your future?

Here’s how you work it out.

Once a year or so, it’s a good idea to give yourself a mid-life MOT.

This shows you:

It’s not as tough as you may expect to give yourself a mid-life MOT, either…

All of the above you can do yourself with a spreadsheet and writing down some lists for yourself.

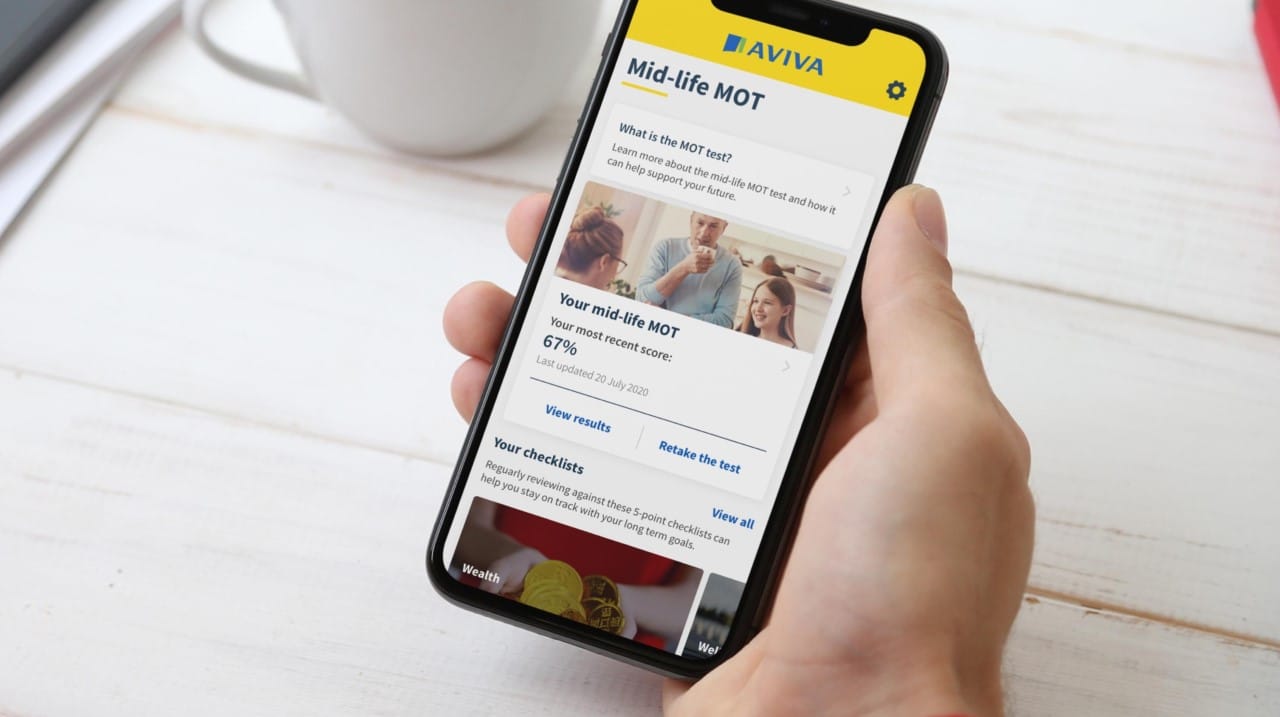

But there’s now an even easier, and probably more accurate, way to do it, thanks to a new app from Aviva.

This free-to-use ‘Midlife App’ is for people who are 45-60 to give themselves a quick, personalised MOT to see if they’re on the right course financially.

The app (which is available for Apple and Android) has:

It’s totally free, doesn’t store your data, doesn’t try to sell you Aviva products and doesn’t give you financial advice. It just directs you to other sources of help for wealth, work and wellbeing, which is a relief!

What it does do is give you guidance in thinking about these three important elements of your life: wealth, work and wellbeing, in the following ways:

Try it out for free here and let us know what you thought of it in the comments below.

There are various other places you can get some specialist financial information, too. Obviously this website is full of information and help for people of all ages and we have articles on all aspects of saving, investing and getting work.

You can also get direct answers to your money questions on our discussion boards here. Put your question there and someone will answer it within 24 hours. We have journalists and specialists on hand who can help with all issues so try it out now.

There are various charities and Government organisations that give free advice to people in need. Here are a few of them:

Yes, I know, they do charge, but most offer a free initial consultation. You could – if you were feeling naughty – make appointments with a few of them and get a few free hours of advice.

Having said that though, to get genuinely helpful advice they need to know quite a bit about your circumstances and then need to crunch some numbers. So, if you want proper advice at this stage, be prepared to put your hands in your pocket. An advisor’s average hourly rate is about £190. It’s often well worth this expense as they can help you find ways to make your money work hard for you – and they also spot where you could be losing money you don’t need to.

If you’d like to get a free session with a highly-rated advisor near you, find out how to do that here.

So if you’ve done your own, personal mid-life MOT, either on the back of an envelope or through the Aviva app, and you’ve found that there’s not going to be enough cash to give you the sort of life you would like in retirement, there are three things you can do:

It’s not always easy to save more if you’re on a fixed income and you have many demands on your money. Maybe you have adult children who have come back to stay with you because they can’t get a job at the moment. Maybe you have an aging parent who needs to be supported. Everyone has a different situation and there’s no one-size-fits-all solution.

However, once you have done your money MOT, it might be worth doing – or redoing – your personal budget to see if there really are ways that you could free up some extra money day-to-day.

Take a look at some of the articles here to find some clever budget hacks that will help you set aside more money each week to make your retirement a cool one! Also, see here how to turn £25 a month into thousands for retirement. And 15 frugal living tips to save you £5000 a year.

It’s easy to say keep working, but it’s not possible for everyone.

If you are willing and able to work, there are big physical and mental health advantages to it.

A report from the Stanford Centre for Longevity says that “compared to those who are retired, adults of the same age who work have higher levels of cognitive functioning.” And a 2016 study in the Journal of Epidemiology and Community Health showed that working even one more year beyond retirement age was associated with a nine per cent to eleven per cent lower risk of dying during the 18-year study period, regardless of health.

However, although it’s illegal for an employer to make you retire at any age in most professions, there are ways that most of them find to ‘persuade’ you to go. You also may not feel that your current work is something you can physically continue to do.

According to Alistair McQueen, Head of Savings and Retirement at Aviva, “at the age of fifty, about eight-in-ten of us are active in the labour market – in work or seeking work. As we progress through our fifties, this participation falls like a stone, towards five-in-ten as we enter our sixties. By the time we eventually reach our state pension age most of us have already exited the labour market. Some through choice, but many without option.”

So what do you do about this later-life working issue?

Something we are very keen on here at MoneyMagpie is people setting up their own businesses and doing their own thing to make money.

This is very much the case for people in mid-life. There are LOADS of opportunities for people with skills, experience and the will to get out there and make money!

Take a look at the hundreds of articles we have here that will help you make and save money, whatever your age, but particularly if you are 50+.

For example,

Then we have literally hundreds of ideas for making money on the side or setting up your own business in our Make Money section. Spend a little time going through that for ideas.

All sorts of people are getting together through our messageboards and finding support and help.

If you have questions about redundancy, investing, saving, new job ideas or just want a chat, get onto our messageboards and ask some questions. We’re here to answer them and the community is also there to join in the conversation.

You are not alone!

*This is not financial or investment advice. Remember to do your own research and speak to a professional advisor before parting with any money.

Good advice, I definitely need to do this.