Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

The last few years have seen an explosion in the number of accessible trading platforms catering to a surge of interest in DIY Investing. As a result, it’s never been easier to get involved and build an investment portfolio yourself. Even so, it’s worth bearing in mind that the accessibility itself brings with it challenges and risk which might not be immediately obvious to the unwary DIY Investor.

The good news is, you can prepare for these challenges by acquainting yourself with some of the risks. At the same time, you can improve your understanding of some of the fantastic opportunities that exist out there.

In the first of several articles sponsored by Aurora DIY Investing, we give you an overview of some of these challenges. In Part 2, we’ll take a deeper dive into the concept of Risk and Risk Tolerance to help you better understand your own investing style and approach.

With all these great new trading apps and platforms, it’s easy to understand why one of the most common rookie investing mistakes is diving right in without a plan. In investing, as in life, this can significantly increase the risks you’re exposed to because without a plan you have no real basis for judging results or learning from your successes and failures. Doing research when investing in stocks is vital.

Many successful DIY investors set firm ground-rules based on their short- and long-term goals; they think about risk tolerance and time horizons and use that plan to help guide their decisions on suitable investments and how they want to organise them – all the while setting concrete expectations and goals. If things change, as they often do (!) or they start to second-guess their investment decisions, they can then refer to the plan- and refine it as necessary.

We’ll be discussing the whole concept of Risk and Risk Tolerance in more detail in Part 2 but the first step in the planning process is determining what kind of investments are right for you. Are you looking for reliable sources of passive income for the long term? You might be interested in Dividend Stocks. Or, perhaps, want to find short term investments with fast earning potential? In this case, High Growth, sometimes called Momentum Stocks might be more suitable.

These are the kinds of questions you should be thinking about before you begin your investing journey because it’s the answer to these that will help you understand your own risk tolerance, style and preferences, which in turn will help you decide which types of investments are right or wrong for you. This is called Asset Allocation and we’ll be looking at that in more detail in the second article.

We’re all exposed to the information explosion in our daily lives. In fact in this year alone, human beings have generated more data than in all the years up to 2017 – but there are few fields more dense and confusing than the world of finance and investing. Filtering the ‘signal’ from the ‘noise’ can be a challenge for even the most experienced investors and finding reliable sources of information to help you make decisions can be costly and time-consuming.

Unfortunately, without some reliable means of getting the quality of data you need you open yourself up to making poor, uninformed choices and failing to make the most of your capital so finding an accessible, comprehensive source of objective data and analysis is a key way you can begin to address this.

“Everybody likes to talk about their winners, but you never hear about their losers.”

You might have noticed that human beings are prone to error!

Without realising it we miscalculate probabilities, find patterns in sparse data, infer correlation from causation and get drawn to details which confirm our existing beliefs, generally making all sort of errors in thinking which can lead to bad decision making. These ‘cognitive biases’ have been studied extensively in the psychology of personal finance and investing – and that’s because they make such an impact on the choices we make.

To give you one simple example; you’ve probably seen the headlines about amateur investors making (and losing!) huge sums on trendy ‘meme’ stocks. It can sometimes be very tempting to follow the herd and pile in on ‘opportunities’ which have great popular appeal or some excitement around them but might have significant downsides and don’t necessarily have any real, long-term potential. This can open you up to significant risks and new investors are particularly vulnerable to getting caught up in hype because they don’t have enough experience or information to exercise appropriate caution.

There’s no getting round it, behavioural research shows us that when it comes to investing our instincts can very often be wrong – so if we’re making choices based on what we’re reading on a particular day, or how much we like a particular product, we can be missing out on better opportunities elsewhere – or worse, actively working against our own best interests.

It goes without saying that experience can help here a lot, but even the most experienced investors will tell you that you can increase your investing returns by removing emotion from the equation. Developing a questioning mindset and knowing where you can go to answer those questions is hugely important but finding objective sources of information is invaluable.

One of the most effective and flexible ways of removing emotion from the investing equation is to use what is known as the ‘factor investing ’ approach which lets you define key ‘factors’ and use consistent, timely data to inform your decisions. (Read more about how to create a Factor Investing strategy here).

New investors might assume that DIY Investing is as straightforward as choosing funds that top a performance league table or the stocks which appear to be growing the fastest. Even though the disclaimers constantly remind us that past performance is no guarantee of the future.

To select a stock or fund purely on the basis of historical data alone is akin to driving a car at high speed while staring in the rear-view mirror and not looking ahead. This is a criticism often levelled at the so-called ‘technical trading’ approach in which historical patterns are used to predict future stock movements.

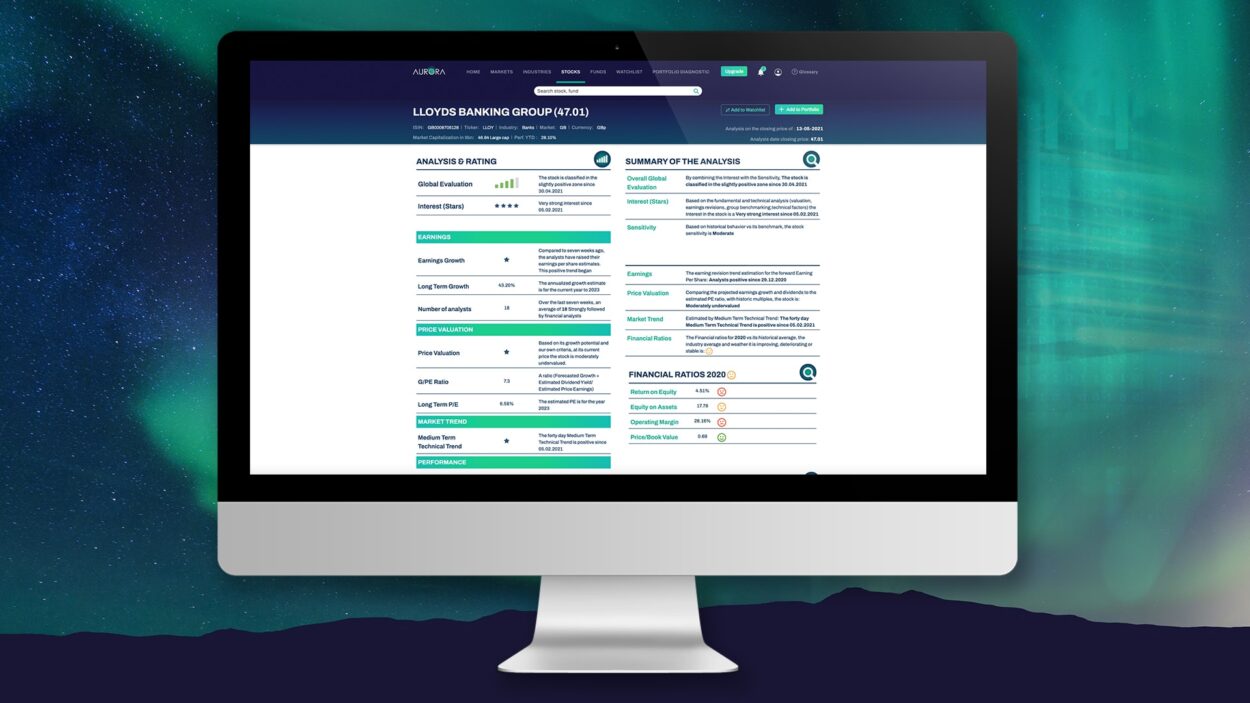

It is important not to underestimate the impact that access to timely, quality research can have on your investment decision-making but equally you really want to also have access to the kind of analysis that can help you turn that raw data into something more useful – that can actually inform your view, not only on the historical performance of an investment or portfolio but how it is performing right now against various benchmarks and metrics, giving you a much more accurate view of a company’s health and prospects.

When people discuss diversification it’s often in terms of the benefits of increasing exposure to a range of industrial sectors and geographical areas – but there’s actually much more to it than that; it’s also about holding a wider range of different types of assets classes of assets that aren’t correlated – that is they behave differently from each other as conditions in the market vary.

DIY investors can often focus too much on finding the next big thing and sometimes don’t realize that their portfolio is becoming heavily (even dangerously) over-concentrated in one particular area. This over-concentration can have a negative impact on the growth of your portfolio over time because if issues arise with the class of assets or industry in which you’re concentrated, this can have an outsized effect on the value of your portfolio overall.

Furthermore, as investors’ circumstances become more complex and nuanced, additional considerations come in to play: Marriage, mortgages, kids’ education, retirement and inheritance planning, all come to play a part- and when the stakes are higher, the cost of investing mistakes becomes more potentially costly.

In part 2, we’ll be taking an in depth look at risk itself, asking what kinds of risk there are and how you can begin to understand your own ‘risk-profile’ as well as how ‘Asset Allocation’ can be crucial for building a high-performing portfolio that meets your very specific needs.

Eyal Perry and Jacob Bettany, Aurora DIY Investing, 2021

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.

An interesting article.