Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

St. James’s Place (SJP) is a British financial advice company. It combines face-to-face advice with investment products and services. With over 30 years of experience and nearly 5000 advisors, St. James’s Place is the largest company of its kind in the UK. Doing a deep dive, we hope to answer some reader questions on the company. We ask the question “”Is St James’s Place a Good Place to Invest?” and look closely at what other clients have said about their experience of working with SJP. Read on and decide for yourself.

People often assume that financial advice is only for the very wealthy. This isn’t true. Managing your finances is important, no matter what your income or your long-term financial goals. One of the best ways to manage your finances is to seek an expertexpert advice to help you make good decisions.

Think of the money in your bank account. It might be earning a bit of interest but really, it’s not working very hard just sitting there. By taking advice and investing your money, you are effectively giving your money the opportunity to grow over time and therefore do more for you. Investing is your money’s way of giving back.

At St. James’s Place, you can speak to a qualified financial advisor who will help you decide what to do with your money now in order to look to reap the benefits in the future. Throughout your relationship with SJP, your advisor will stay in regular contact with you to ensure that your money is working hard for you.

There are lots of reasons why using a financial advisor is beneficial. Even if you have a good grasp of how investments work, how the stock market functions, or how to buy shares, unless it’s your full-time job it’s unlikely you’ll have as good a handle on these areas as someone who spends all day every day working in this sector.

According to the International Longevity Centre UK, a person who uses a financial adviser is on average £47,000 better off when they retire.

An experienced financial advisor will talk to you about you – your lifestyle and family, your income, debt, current assets, your work and future plans. They use this information to make recommendations based on your individual needs. This way you are much more likely to be given advice that is appropriate for your unique circumstances.

A financial advisor will put all of your options on the table for you to consider. Even if you are familiar with the financial landscape, you may not necessarily be aware of all the choices that are available to you. Using their expertise, your advisor can help you review your current needs whilst also guiding you when it comes to meeting your needs in the future – for example retirement or estate planning.

Lastly, a financial advisor can help you make the most of tax reliefs and available allowances. This means they do the hard work for you. With regular meetings and reviews, they will ensure that your money continues to work hard, while you get peace of mind knowing your money is in safe hands.

At St. James’s Place, their financial advisors are referred to as ‘Partners’. This reflects the attitude they take to their relationship with you. It’s a partnership. More on this later.

With over 30 years of experience, SJP’s skilled financial advisors (‘Partners’) use proven strategies to help your money grow over time. They take a long-term view of your financial situation to make sure you have what you need now – as well as what you will need in the future.

St. James’s Place can also advise on retirement and estate planning; life assurance and critical illness cover; and banking and mortgages. They see this as part of the package they offer to their clients. Here we are focusing on investments and investing.

Whilst the UK (and world economy) is in such turmoil, people need to know that their money is safe. Therefore, they need to find any signs that their chosen financial company is secure and thriving. Take reassurance in the fact that SJP remains the UK’s largest wealth manager, with a substantial customer base (over 900,000 clients) and customer satisfaction (Rated Excellent on Trustpilot and VouchedFor.)

If you ever want a true picture of a firm, it is always crucial to check these consumer reviews as they offer the truth. Whilst people may suggest fake good reviews are possible, it is the lack of bad ones that you need to be aware of. The fact St James’s Place have such high overall ranking is a great sign.

SJP are also a company who are fantastic at adapting to change and with their new fee structures (detailed below), and the appointment of a new CEO, Mark Fitzpatrick, there are many indicators that they are not going anywhere.

An investment portfolio is probably a financial term you’ve heard but may not be able to define. It is one of the most important terms you need to understand when it comes to investing. Very basically, an investment portfolio is a collection of assets. (Assets are stocks and shares, bonds, property, even cryptocurrency – anything that you own.)

This is where a financial advisor is really useful. They will look at all of your assets, alongside your circumstances and long-time financial needs, to create the investment portfolio that is best for you. To put it another way, if for example you want to retire at a certain age, your SJP advisor will work out the very best investment portfolio to achieve your specific goal.

Creating an investment portfolio means either investing for the first time or reviewing and even reinvesting assets you already own (or a combination of both). For lots of us, this can feel like something that only other people do. It’s daunting, possibly quite over-whelming. What happens if you make the wrong decision?

This is where using an experienced financial advisor is especially helpful. Their job is to explain all of the options open to you in a way that you understand. For starters they will describe to you all of the different investment accounts and choices that are on offer. Each will have pros and cons such as being tax-free or being better for long term investments.

You don’t have to pick just one option – your advisor will help you put together a range of investments that will cover all your bases. So, you may have a combination of ISAs, stocks and shares and a pension. These are what form your portfolio.

Another advantage of using a financial advisor is that they will be able to explain levels of risk to you. How your investment portfolio performs depends on the level of risk you are comfortable with. For instance, higher risk investments are likely to have bigger peaks and troughs in the short term but will often have better growth in the longer term. Whereas a lower risk investment portfolio is less changeable, but the growth is slower over time.

Sadly, more and more people are falling victim to financial scams. The scammers are getting more ingenious which is making it harder to spot whether something really is too good to be true. Millions of pounds are lost every year to con-artists. One of the biggest advantages of using St. James’s Place is that they have a team of people whose job it is to help protect you from financial scams.

Knowing that your money is safe and that SJP’s Partners have your best interests at heart, means that you can be confident when it comes to choosing to invest your money.

Let’s get down to the details. How do the Partners (advisors) at St. James’s Place work out what’s right for you and your needs?

Firstly, let’s establish what kind of advice you can get at St. James’s Place.

The sort of advice you can get with SJP is called ‘restricted advice’. This means that their advisors only work for their own company or investment firm.

The other kind of advisor is called an ‘independent financial advisor’. This type of advisor offers a similar service, but the big difference is that they work for themselves. They are independent. This means that they have a duty to look at a really wide range of different investment opportunities available on the market before they can offer any advice or make recommendations.

The other big difference is that an independent financial advisor doesn’t manage the investments themselves. They offer advice and then buy the investments on your behalf.

Restricted advisors, which is what they are at St James’s Place, do not have to search for every investment option available on the market, but rather will offer advice based on the range of investments that SJP has already researched, including many of the largest investment fund managers from all over the globe. More on this later.

With an investment firm as well-established and as big as St James’s Place, the advantage of restricted advisors is that you can be sure that whatever they recommend will not only be based on your individual requirements, it will be based on years and breadth of experience.

Another thing to note is that your SJP Partner will be local to you. They have around 5000 on their staff. With such a well-known brand and being a big company, they hold their staff to very high standards of service.

All of these different elements come together to make sure you get the best advice possible.

Let’s talk about tax. Ok, nobody really likes to talk about tax, but it’s really important to remember you have to consider tax implications when it comes to any sort of asset or investment both now and when you pass away. (Again, not a comfortable topic of conversation, but something that needs to be planned for – for your sake and for the sake of your nearest and dearest. This is referred to as estate planning.)

Tax can be incredibly complex and it’s easy to get it wrong. When we get it wrong there’s usually a hefty fine to pay. If you are well-informed, you will save yourself and your family a lot of money.

A good financial advisor will not only offer investment recommendations, they will also help you make the most from your money by being tax efficient. That simply means paying the lowest – but correct and legal – amount of tax you can.

An SJP advisor can give you guidance on the tax-free allowances for pensions, how to reduce capital gains on bonuses or on dividends. There are also products such as ISAs which are a type of tax-free account which you can pay into up to set amount each year. Lastly, there’s IHT (Inheritance Tax). You may think you don’t need to worry about that yet (or at all) but there are ways to ensure your loved ones pay less with good estate planning.

Your relationship with your SJP financial advisor is a partnership. That’s why they SJP calls them Partners. They work with you to make sure your money is doing its best for you.

This doesn’t mean that your financial advisor is going to be texting you every day or ringing every Sunday for a catch up. They will tailor the amount of contact you want and like to your needs and preferences.

Investment funds are a collection of investments or assets. They are very popular and pretty standard in the industry. Most people who have long-term investments will be familiar with investment funds.

The reason they are used is because it’s cheaper to invest in a fund than to purchase the investments individually. On a very basic level, they are contained and easier to handle and understand.

Here we’re getting down to the nitty gritty and terms (or asset classes) you need to understand in order to get to grips with how your investments will work:

When you buy stocks and shares you are buying a piece of a company (a share). When that company increases in value so does your share increase in value. When you buy a share you become a shareholder. Another useful word to know here is ‘equities’ which is another way of describing stocks and shares.

A bond is type of loan. Bonds, gilts and treasuries are all much the same. They are basically a way for governments and businesses to issue debt. You buy some of that debt then, at an agreed date in the future, you are paid back the money you lent, plus interest. Bonds are themselves quite simple, but the bond market is really complicated. For now, all you need to know is that it’s an established form of investment.

Commodities are economic goods, such as minerals or coffee and corn, silver and gold. Energy can also be a commodity. People trade in commodities but just like the bond market, the commodity market is incredibly complex and involves things like futures contracts. You can read more about what that means here.

Part of an investment fund could involve making money from rent from commercial property.

Each investment fund is made up of any combination of the above asset classes. The funds are designed according to the requirements of different types of clients, for example your long-term financial goals or risk level.

Your financial advisor will run through the different types of investment funds available to you, including what they mean, the importance of diversification and how they relate to your individual requirements. These funds can then be held within a product or wrapper which have different benefits and are appropriate depending on what you need:

As we’ve seen, a Financial Advisor will suggest which investment fund is best for your needs. But they don’t manage the funds themselves. That is done by professional Investment Fund Managers. These experts choose which investments or assets should go into which fund. For example which shares to invest in or which bonds to buy.

At St James’s Place, the Fund Managers don’t work directly for the company but do manage funds exclusively for the firm. This means that SJP can cherry pick the best in the business and each Fund Manager is matched with the right fund for them.

Each Fund Manager reviews their funds constantly, making sure they are growing over the long-term and making adjustments as needed. In turn, the Fund Managers themselves are reviewed by The St. James’s Place Investment Committee to make sure they are performing at their very best.

When you invest with SJP you are paying for their expertise, advice and the products they recommend.

When you have your first meeting, you’ll be given a personalised illustration of the charges you can expect to pay. You can (and should) discuss these charges with your financial advisor before committing to taking your relationship further.

4.5% of your initial investment + a 0.5% annual charge

1.5% of your initial investment + 1% annual management product charge (which is waived for the first 6 years for each investment)

In addition to charges for the advice and the product, there are charges for managing and maintaining your underlying investments. These depend on the funds you choose to invest in.

IN 2025 St James’ Place will be adapting to change of the UK economy by having a full overhaul to how their fee structures work. However, this year the fund charges will only change for new and existing investments. These core changes take a consistent approach across all investment products, to better align the price paid with the value received. This change in fee structure will be rolled-out gradually over a two-year period.

There are three parts to the changes:

The charges on Bonds and Pensions currently have an Early Withdrawal Charge instead of an explicit initial charge (as they have on their ISAs and Unit Trusts). The charging structure for Unit Trusts and ISAs will be removed from their charges. The future charging structure will mean that new Bond and Pension investments will have an explicit initial charge and ongoing charges (as is already the case with the Unit Trust and ISA charges).

They are going to start separating the charges to make each element extra clear – ensuring that the charges are very simple to understand and easy to compare with other offerings from other providers.

The components of the charges are:

– The advice charge,

– The product/platform charge,

– The fund charge.

These components of the charges have also been reviewed to ensure they more accurately align to where you get the most value.

It is important to note that no existing client will pay higher ongoing charges on their existing investments as a result of separating out the charges, and for many the charges will indeed reduce. Within this change, some components of the charge will be higher, some will be lower than today.

Are SJP Charges High?

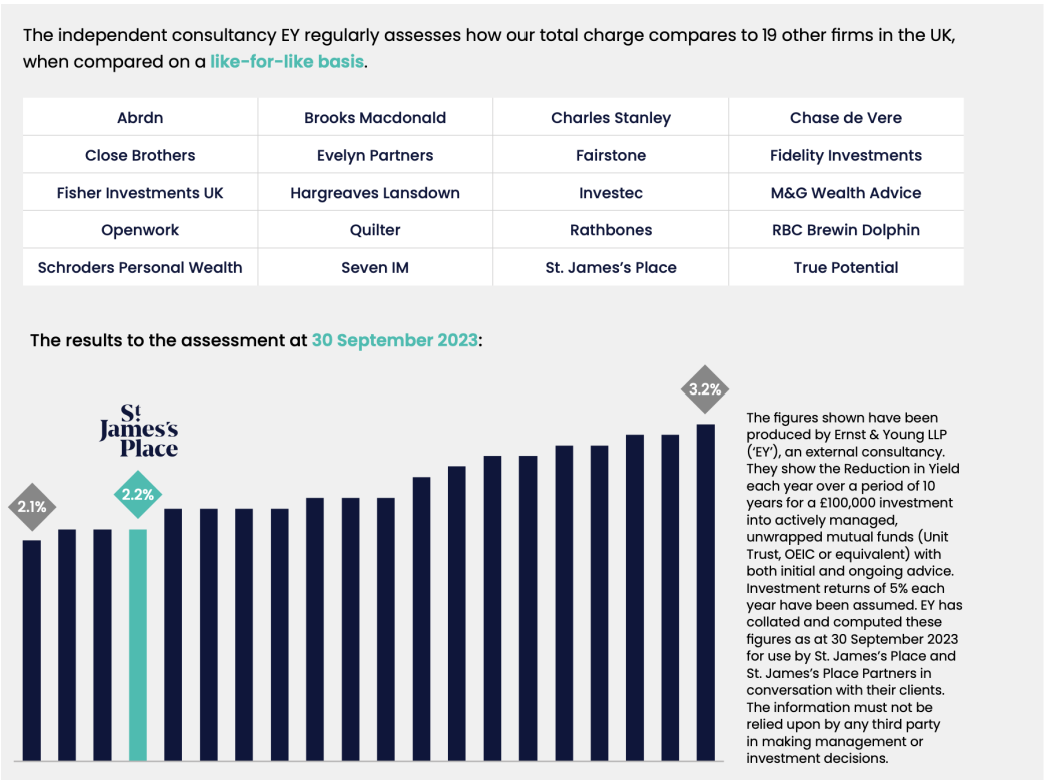

As you can see in the attached graph, St. James’s Place actually sit at the lower end of the scale when it comes to affordability and when compared to 19 other regulated firms in the UK, they were in fact the fourth cheapest.

How do SJP’s charges compare to other financial advisors?

Independent research carried out by Ernst & Young (EY) show that SJP’s charges are fair and no higher than other similar companies.

It’s worth remembering that the charges you pay SJP also cover the ongoing advice you receive, which is where the real value lies – your SJP Partner is only a phone call or email away if you ever have a question or want an update on how your investments are doing.

Plus, if your personal or financial situation changes you can meet with them to see if your investment plans need to change accordingly.

So, there you have it. St James’s Place. But what do their customers say about them and their performance? ’

The Financial Services sector has a customer review platform that is specific to the industry – VouchedFor. St. James’s Place has over 20,000 reviews and out of those they score an impressive 4.9 out of 5 and with one St James’s Place review suggested that there was “nothing” that the company could improve on. Here are three of the most recent (at the time of writing) – so you can judge for yourself:

What were the circumstances that caused you to initially look for an adviser?

I needed to get enhanced annuities for my wife and me which were not offered by the pension provider, Phoenix Life.

How has SJP helped you?

He procured better deals than were on offer from Phoenix

Have you seen the outcome you were hoping for?

Yes

What could they have done better?

Nothing

What were the circumstances that caused you to initially look for an adviser?

Retirement.

Have you seen the outcome you were hoping for?

Due to the current global financial situation, my investment hasn’t performed as well as I’d hoped.

How has SJP helped you?

My situation with regards my investment has changed, and Keith has been brilliant in advising me of my options going forward.

What could they have done better?

Nothing.

What were the circumstances that caused you to initially look for an adviser?

I had a change of career direction and wanted to make sure I had finances in order following the changes. I also wanted to make sure I had savings in place for my children.

Have you seen the outcome you were hoping for?

Yes

How has SJP helped you?

Makes understanding finance and investments easier, helped review pensions, sickness cover/policies, set up investments for children

What could they have done better?

Nothing

Here are some examples of what customers have to say on Trustpilot. SJP has far fewer reviews there (just under a thousand) but still manage to score 4.6 out of 5. Again, here’s a selection of what some of their customers have to say:

Trustworthy. Weight of an industry giant.

I feel in very safe financial hands with SJP. They have given me the financial wakeup call I’ve always needed. Got the Kids JISA’s, my Ltd Company Pension, looking to start a SIPP and possibly some future tax planning with SJP. Quality and usefulness of the financial advice is unparalleled. Thank you so much Robin!

Guiding light

Claire makes everything easy to understand. She has a gift for explaining things in layman’s terms. And, despite the current state of the world we live in, she has obviously invested wisely on our behalf and is guiding us through as safely as she is able.

Always available to discuss your investments

I have only been a client for just over twelve months but I am happy with the way in which my investment has been handled. It is really nice that the representative is always available if I want clarification or information.

Trust is key

I have been a client of Stringer Mann in Berkhamsted for many years and trust them – and by association SJP – implicitly. I like the way they conduct business, present themselves and the tools they provide to help me visualise and plan my financial future. My investments continue to perform extremely well and I have a level of reassurance with them that I never had before. I regularly recommend them to friends and family.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.

Direct to your inbox every week

New data capture form 2023

Leave a Reply