Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

The Government is still set on raising the National Insurance rate by a steep 1.25% in April, despite calls from all sides to postpone it because of the toll inflation is taking on consumers.

I am one of the voices that is calling for this postponement because I consider that we are coming to a cost of living cliff edge in April and the National Insurance hike would push many people over.

The Government announced last year that they would increase National Insurance (NI) payments for all working people by 1.25% in order to pay for Care.

We all know that the cost of Care is breaking local and national government and that the demands for later-life Care are increasing. However, I suspect that this money will actually go towards paying off part of the insanely high debt the Government has accrued through the lockdowns of 2020-21.

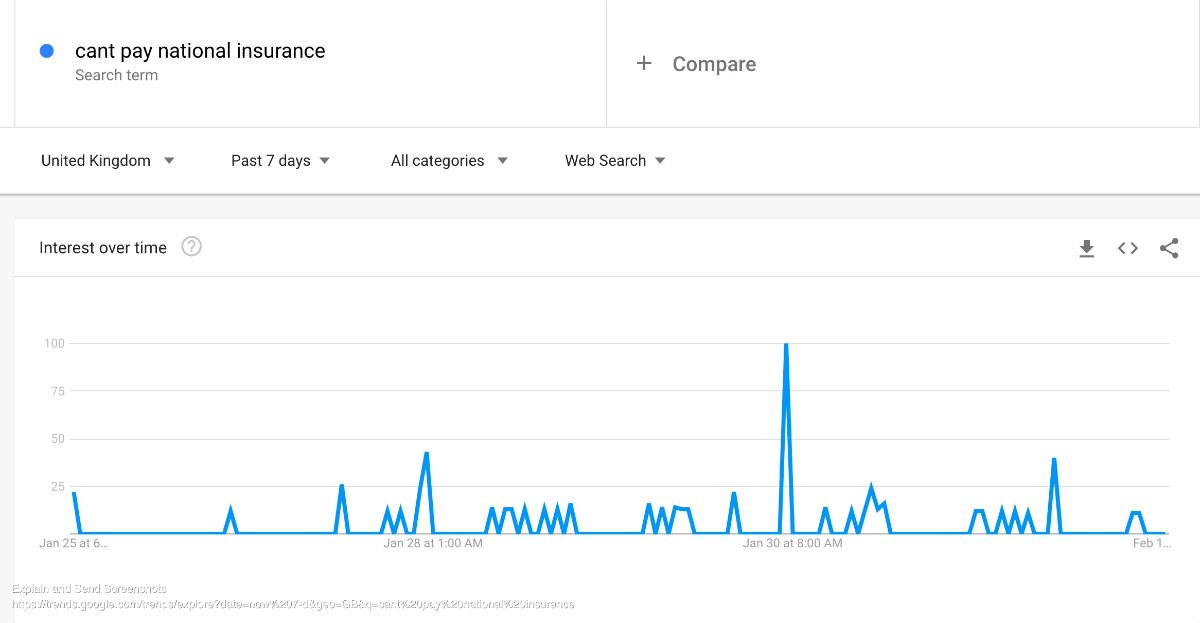

Analysis of Google search data by Income Tax Calculator UK shows that searches for “Can’t pay National Insurance” skyrocketed 2500% on the 30th January, the same day that Boris Johnson and Rishi Sunak confirmed the NI increase for April.

The UK’s highest earners will contribute the lowest percentage of their income to National Insurance, while average and middle earners will contribute the most.

National Insurance is calculated in bands depending on how much you earn.

Retired people don’t pay NI unless they are working on the side. If they earn enough each year they may fall into an NI payment bracket as seen here

|

Income |

National Insurance Increase |

Overall National Insurance 2022 |

% of Income spent on National Insurance |

|

£20,000 |

+ £130 |

£1381 |

7% |

|

£30,000 |

+ £255 |

£2706 |

9% |

|

£50,000 |

+ £505 |

£5086 |

10% |

|

£80,000 |

+ £880 |

£6359 |

8% |

|

$100,000 |

+ £1,130 |

£7008 |

7% |

The Government is in a difficult position – frankly I think it has put itself into this position, but that’s for another column – and it needs to claw back billions in lost revenue from the last couple of years.

However, taxing people – particularly taxing the lower earners – is not a helpful way to do it while the cost of living is soaring.

It would be better to support the growth of the economy – essentially keep increasing the national debt! – to enable businesses to flourish, make more money and therefore bring in more money in tax revenues.

They could bring in the NI hike next year or the year after…essentially whenever prices calm down again.. It doesn’t have to be scrapped entirely.