Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Paying into a pension in your 20s will make a huge difference to your future. Yet, over 10% of women and 8% of men aged 20-29 opt out of their workplace pension scheme. If you’re one of them, it’s time to reconsider: sacrificing some cash now will make you RICH in retirement.

From compound returns to pure time-to-investment ratio, the earlier you pay into a pension, the better your retirement looks, and the great thing is that YOU DON’T HAVE TO PUT MUCH IN NOW

TO CREATE A LOT OF WEALTH LATER ON.

Here’s how – and why – you should pay into a pension right now.

When you’re strapped for cash at the start of your career, it’s understandable that you want to see the full amount of your salary every month. Pension contributions taken off your pay packet can seem pointless – and make you feel more broke, too!

However, you’re seriously missing out if you opt out of your workplace pension scheme.

Yes, you have to give up at least 5% of your monthly salary. However, your employer ALSO pays out at least 3% of that on top – PLUS the Government tops up basic-rate tax payers’ contributions by 2%. So, you get an EXTRA 5% into your pension than you’d get into your pocket. That’s FREE MONEY!

You wouldn’t get that extra cash if you opt out of your workplace pension scheme.

Your pension is taken off before you pay tax on it. Opting out and getting the money means you’ve already paid more tax on that cash than if you paid it into your pension.

Yes, pensions ARE taxed when you take them out. However, the first 25% (either a lump sum or 25% of each payment, depending on the type of pension drawdown you choose) is TAX FREE.

Why pay tax on cash now when you can have more money, less tax in the future?

The other thing about paying into your pension in your 20s is that you’re not able to touch your money until you’re at least 55. That means you could have 35 years of investment time on your savings.

Remember: that’s investments made up of money you’ve earned AND free extra money from your employer and the Government.

The longer you invest your money, the more time there is for growth. Stocks and shares go up and down over time – but over decades, the overall trend is up. That means your investment can work harder without you having to do a thing.

Investing as early as possible in your pension also means you’re not going to lose out later in life. Many people don’t start paying into their pension until their 30s or even 40s – and as such, they have to sacrifice a LOT more of their salary. That often means giving up luxuries you’ve got used to having – or not being able to save for other things, like moving house to accommodate a growing family.

When you have to sacrifice huge chunks to make up your pension later in life, you also won’t get the full benefit of employer contributions. Your employer only has to pay 3% of your current salary – not match 3% of what you choose to pay in. So, if you opt out for ten years, then pay in a huge chunk of your salary each month to make up for lost time – you’ve missed out on those 3% contributions for an entire decade.

That has serious implications in terms of gains from compounding returns, too.

Compounding returns is when your investment grows over time and the profits are reinvested in your pension pot. You could pay into your pension in your 20s, skip a few years of payments in your 30s, and still see growth!

If you’ve opted out in your 20s and missed ten years of 3% employer contributions, the interest you’ve lost on that investment is massive.

You’ve not only lost the free cash from the 3% contributions, but the potential returns they generated. The more in your pension pot, the more can be invested – and so the higher your returns. When you’ve got a bigger profit to reinvest, that inevitably speeds up the growth of your wealth.

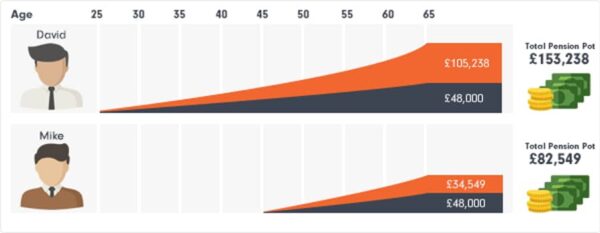

This example from Fidelity is great: it shows in one graph how you could pay in the EXACT same amount as someone else – but if you’ve paid in 20 years earlier than they did, your pension will be worth CONSIDERABLY more:

The great news is that, if you start paying into a pension in your 20s, you don’t need to sacrifice such massive chunks you’ll notice it. If you wait until later in your career, you’ll DEFINITELY notice the lower income after bigger monthly pension contributions!

The first thing to do is check your workplace pension scheme: if your employer offers more than the 3% minimum, try to match it. You have to put in 5% contributions minimum, and many employers will match this anyway. However, some will match your contributions up to, for example, 8%. That’s an EXTRA 5% free cash on your investment than the legal minimum – why turn it down?!

Saving £80 a month might seem like a lot – but if you include minimum contributions, you need to sacrifice £40 each month. The other £40 is made up of your employer contributions and the Government top-up!

A general rule of thumb is to save 10% of your salary each month when you’re in your 20s and early 30s. Over time, increase this by 1% or 2% as your salary rises. Scaling up by a percentage or two each year is a good way to build your pot without noticing a huge difference in your take-home pay.

If you can’t afford to save 10% in your 20s, make sure you’re at least meeting your minimum 5% contributions. A little saved now can still mean massive wealth growth over time!

Ideally, the more you can save, the better.

You’re so young you also have time to save in other – more readily accessible – investment products, too.

So, rather than saving every spare penny into your pension, make sure you’re setting aside some each month for things like a Lifetime ISA to help buy your first home, and Index Tracking Funds to boost your wealth.

A LISA, for example, will net you a 25% bonus from the Government on savings up to £4,000 a year. You can use the funds either towards a deposit for your first home, or as a nest egg to access when you turn 60. The advantage here is that, unlike your pension income (which is taxed after the first 25%), you can take the full amount, including the bonus, as a tax-free lump sum!

There are lots of different types of pension to choose from. Which one you go for depends on your circumstances and preferences.

Check your workplace pension scheme first. Your employer’s pension scheme is likely to be a low-cost, low-risk type of pension fund that offers slow growth over time (and less risk on your money).

You could also set up a separate personal pension – or, if you’re self-employed, you’ll definitely need to!

A stakeholder pension is a very cheap and easy pension type. Fees are capped and investments into funds are lower-risk.

A personal pension in a tax wrapper known as a SIPP (Self Invested Personal Pension) is another way to invest in your future. It’s a lot more hands-on and requires either you to understand a lot about stocks and shares – or payment of hefty annual management fees. The risks can be higher – but your growth potential is bigger, too. When you’re in your 20s, a riskier portfolio is good: it grows your wealth before you need to shift it to a lower-risk portfolio when you’re nearing retirement.

Ultimately, you need to think about how much risk you want to take with your money, and where you want to invest. Stakeholder pensions, for example, might invest in funds you don’t like or agree with on a moral or ethical level. Research the funds as well as the provider!

You also need to think about how you want to manage your pension fund. Many providers offer an online platform these days, making it easy to check your pension’s performance, add extra contributions, or change your portfolio. Others will do a lot of the work for you, instead – the fees are higher but the hands-off approach makes it easy to grow your wealth without doing anything yourself.

If you don’t qualify for, or want, your workplace pension, take a look at these pension providers to get started:

Got more burning questions about how to invest in your pension – or what to do with your retirement savings? Comment below! (Or check out our Pension articles to find more answers).