Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

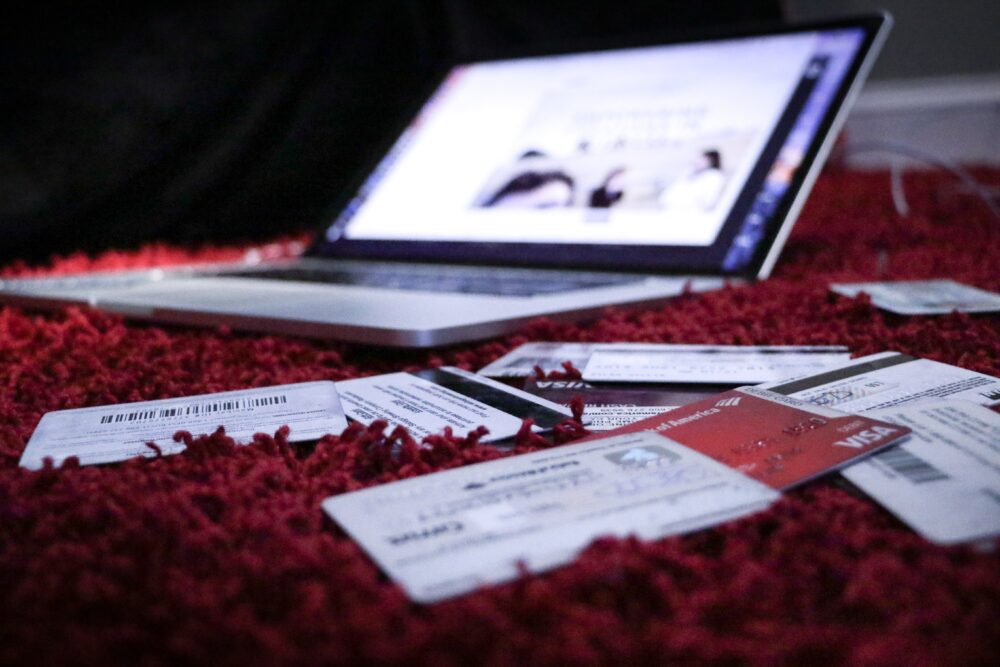

A huge number of UK residents are struggling to keep up with bills and credit commitments, a number which has doubled since the pandemic began. Nearly one in three are in this position, according a new report by the charity StepChange – Falling Behind to Keep Up: The Credit Safety Net and Problem Debt – which shows the effect of financial instability and borrowing solutions that have faced people over the last two years.

About 8.6 million people struggling financially borrowed £26 billion for their basic needs over the last year, including 3.5 million people who using credit to pay everyday bills, according to the study.

65% had kept up with credit repayments by delaying bills, borrowing from family or friends, or going without whereby they put themselves on the breadline.

Fewer than one in four of those people contacted their bank or creditors, despite rules designed to ensure those in financial difficulty could receive support.

53% said they would think twice about seeking help with financial difficulty due to the anxiety and stigma about the issue.

26% of clients who took the StepChange survey were offered further credit even though they were already in financial trouble, 35% had a payment taken out of their account that they could not cover, and 51% had interest added to an existing debt.

StepChange said that it understood how the pandemic had affected millions of peoples income and how “urgent action” was needed to support people struggling without the need for them to resort to getting credit. They are also urging the Government and the FCA to do more to provide alternatives to people being forced to borrow credit, through grants and a Government-supported no-interest loan scheme.

MoneyMagpie’s Jasmine Birtles says, “consumers are facing a squeeze from all sides and it’s likely to continue for a while. Energy prices, food, petrol and even secondhand cars are all going up in price thanks to supply and demand imbalance and also, as I keep pointing out, because of the insane amount of quantitative easing (money-printing) that the Bank of England has indulged in over the last two years. It was always going to end in tears and the pain isn’t over yet. Frankly I don’t believe the official inflation figures. Although 5.4% sounds high I think the real figure is more like 10+% and it could go higher.

“You would think that the government and the Bank of England would be pulling out all the stops to help Brits cope with the rises but I’m not seeing much action. Although the BoE has started to edge interest rates up, they’re still printing money which is like trying to put out a fire on one end while pouring in gasoline at the other. Not only that but it seems that we will be paying even more National Insurance contributions from April which doesn’t help the hard-working average person. Consumers are going to need all the help they can get over the next few months and I’m glad to say that we at MoneyMagpie are ready to help with money-saving and money-making ideas, links, webinars and podcasts so keep coming back here to get new information each day.”