Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

This is a sponsored post on behalf of Little Birdie.

A new year is upon us, with many of us making resolutions we hope to stick to for the coming 12 months and beyond. Resolutions range from doing more exercise to being better with money. If your resolution revolves around saving money, then we have the perfect app for you to try.

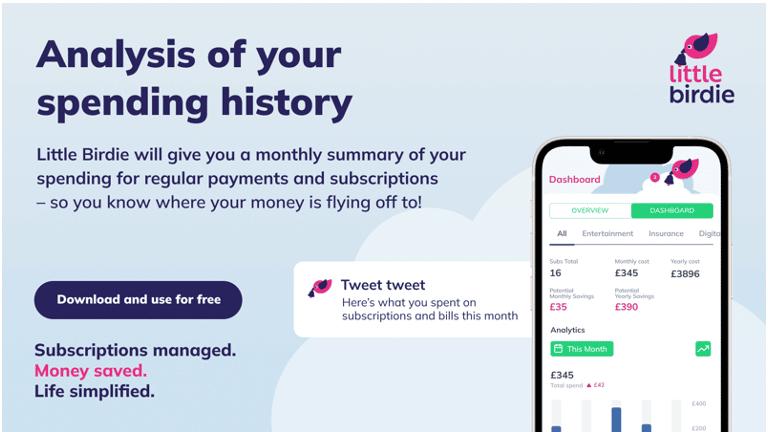

Putting away extra money every month and cutting back can definitely help you save; however, you may be spending money every single month without realising. Where could this money possibly be going? On bills and subscriptions.

According to Nat West, around £25 billion is wasted every single year in the UK as the result of unused subscriptions, forgotten about free trials and bad deals on your bills and other services.

Just recently, one of our Magpies was charged a whopping £90 for an annual subscription after forgetting to cancel a membership after a free trial. Similarly, a reader wrote in to tell us he hadn’t realised he had been paying monthly insurance for a mobile phone he had not even owned, let alone used, for almost three years.

Don’t be shy, this has likely happened to you once or twice. This is where Little Birdie comes in.

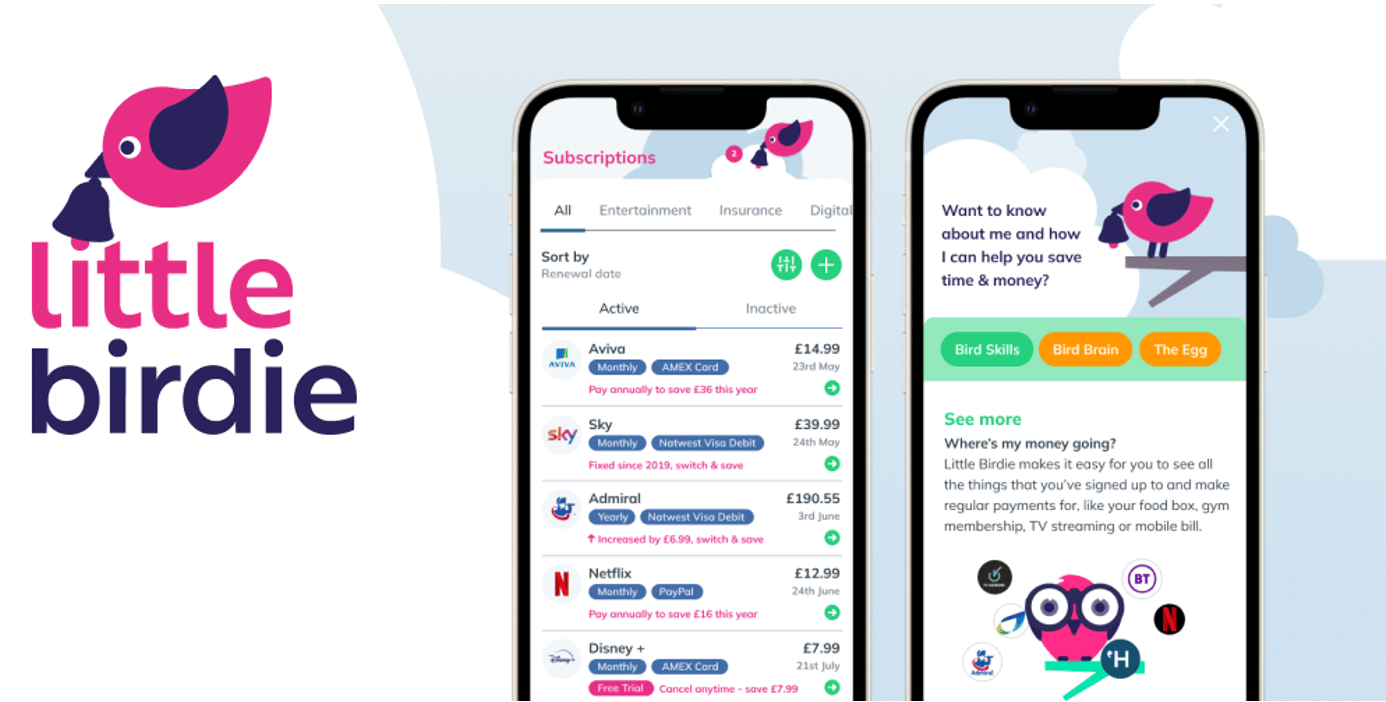

Little Birdie is a recently launched, free, easy to use app that helps you manage your bills, regular payments and subscriptions in one place. It’s a handy tool which may help you become aware of goods and services you had no clue you were even paying for every month. But that’s not all Little Birdie can do!

It may be small, but it is certainly mighty. As well as seeing all of your subscriptions and recurring bill payments simply laid out in one place, Little Birdie will alert you to any price changes to your payments, or looming contract renewals. It will even give you the heads up that a free trial is about to end, through its smart notifications, preventing you from getting sucked into paying through the nose for something you don’t want or use.

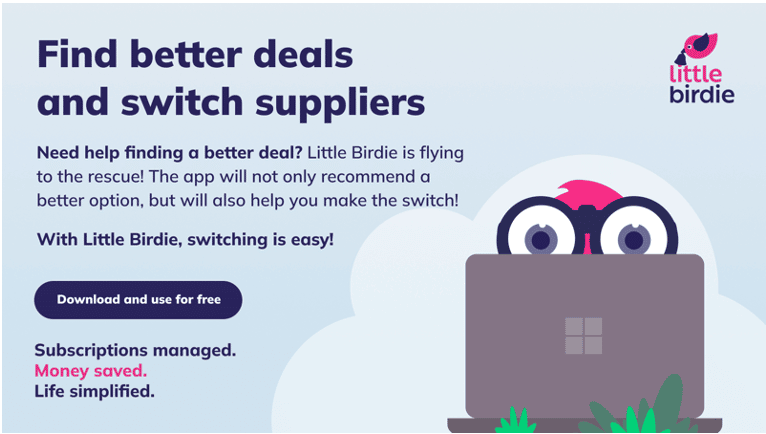

Not only this, but Little Birdie’s price comparison feature helps you find better value elsewhere. Do you have any contracts due to end soon? Take the stress out of scrambling to find better deals, and let the app do all of the work for you. Little Birdie will scour the internet from top to bottom to ensure you have the best deal possible.

If Little Birdie presents you with a better deal elsewhere and you decide to make the move to a new provider, the app will even take the hassle and chaos out of switching, and help you every step of the way.

Now let’s be honest, we have all been in a situation where we need to cancel a contract or subscription. Whether it be because you are moving house, are no longer happy with the service or they’ve implemented a sneaky price rise, it can be a pain to try and cancel a service.

If you thought Little Birdie couldn’t possibly get any more helpful, you’d be wrong. The handy in-app cancellation tool helps you cancel memberships and subscriptions in a matter of seconds. Yes, within a few taps, you can opt out of free trials and memberships. Little Birdie cuts out the middle man and does the work for you.

No more sitting on the phone for hours at a time trying to leave the gym you signed up to eight months ago. No more pressure to stay in a phone contract you simply hate. Although in-app cancellation is not always possible, there are hundreds of companies that allow you to terminate your contract through Little Birdie. These include household names such as Simply Cook, Pure Gym, Disney+ and Amazon Prime.

With your permission, Little Birdie uses Open Banking to scour your banking and card data to find all of your subscriptions. They are then put onto your dashboard, so you can see everything at a glance.

Open Banking is safe and secure, and allowed you to share information from your bank or credit cards with financially regulated providers, such as Little Birdie, to help you manage your finances better.

Open Banking is just as safe as internet banking, plus you can control who sees your information, deciding which bits of information they can see and you can easily remove access at any time.

Our Magpie Izzy decided to put Little Birdie to the test for herself. Here is what she had to say:

“I downloaded Little Birdie unsure of how much it could help me. I’m usually very much on top of my subscriptions and bills. So, I thought I would give it a go anyway, and was pleasantly surprised.

“The sign-up process is quick and easy, taking mere minutes. I did it whilst the kettle was boiling! The app is easy to navigate and as soon as I was logged in, I could start getting everything set up. Again, this was so straight forward and took hardly any time to do.

“I found I was absolutely paying through the nose for my broadband, with another provider offering an identical service and the same internet speed for £9.42 less a month! I used Little Birdie to help me switch and not only was it totally hassle-free; I’m now chuffed as I am saving myself over £110 per year.

“That’s not all, either. I found out I was paying £8.99 a month for Amazon Music – a service I don’t think I have ever used. Little Birdie’s in-app cancellation meant I could cancel this within a matter of seconds, and I now have £9 extra in my pocket monthly – that’s over £100 a year saved with the click of a few buttons.

“Overall, I am thrilled I tried the Little Birdie app. I am now better off financially as a result and can rest easy knowing my money is not being taken without my permission or knowledge. Plus, I really like that Little Birdie is learning every day, slowly getting better and better at giving you deals and offers explicitly tailored to you. I can’t wait to see what Little Birdie finds for me in the future, and how much more it can help me save.”

You can find out more about Little Birdie on the website and on the Little Birdie Facebook and Twitter channels. You can also download the app for iOS and Android.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.