Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Have you been meaning to save money since receiving your first paycheck, but never seem to manage?

You’re certainly not alone! Fortunately, there are a number of ways to make it easier for yourself. One of these is a little Facebook Messenger-based bot, called Plum.

Intrigued? We were too!

Here’s everything you need to know!

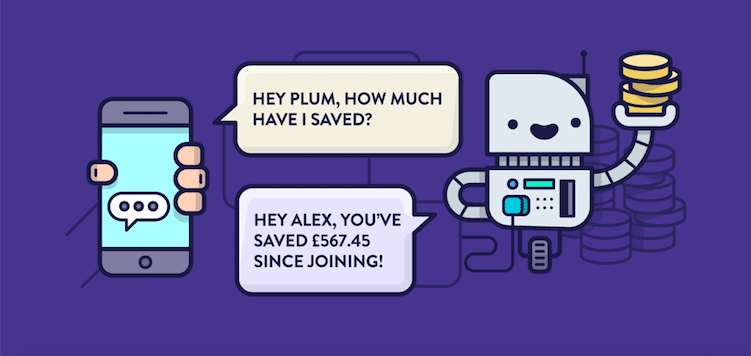

Plum is basically your personal, and rather intelligent, savings assistant that lives amongst your friends on Facebook Messenger. It monitors your spending and helps you save money, based on your monthly spending.

If you don’t have Facebook or recently deleted it, no problem! Plum is still available to you.

Check out this blog post to find out more.

Using technology such as Plum might be intimidating to some. Especially those who have only ever attempted saving through standing orders.

What makes it unique, however, is the fact that it works WITH your fluctuating monthly expenses, calculating an attainable amount to go into your savings.

It does this in the following steps:

You grant Plum read-only access to your transaction data by linking your bank account

To access your data, they partner with Yodlee, a world leader in providing secure financial services to banks and other financial institutions.

The bot will then analyse thousands of transactions and identify your regular income, rent, bills and daily spend. This is known as your ‘unique saver profile’.

Using this profile and other factors like your available balance, Plum’s smart algorithm will run every few days and calculate the right amount for you to save. This amount will be automatically transferred into your savings account via a Direct Debit instruction (covered by the Direct Debit guarantee). Every user gets their own savings account when they first sign up.

Plum will message you to keep you informed on your progress and give you tips and tricks on how to make the most of your money.

What makes Plum even more convenient, is the fact that you don’t have to give any amount of notice to access your savings. They are available 24/7. All you need to do is send a Facebook message saying ‘withdraw’ and your savings will be returned to you within 24 hours.

As mentioned earlier, what makes Plum unique is the fact that it takes your monthly expenditures into account. As we all know, no two months are the same – some have us dipping into overdrafts, while others may leave us with a few cents to spare (or, more likely, spend).

This obviously differs from a regular standing order that assumes you spend exactly the same each month.

Plum will crunch all the numbers for you and adapt to your lifestyle. This means that, throughout the month, it will detect if you are spending less or more than usual and save more or less respectively.

With the recent Facebook information scandal it’s hardly surprising that security would be top of mind for most of us.

Fortunately, Plum is very serious about keeping your details safe. They work closely with data partner, Yodlee, a world leader in providing secure financial services to banks and other financial institutions, to gather the information they need and would never pass it on to any other companies.

They also never store your banking details and use symmetric cryptography to store any sensitive data.

Furthermore, they won’t send you into financial ruin by dipping into your overdraft. Their algorithm includes a number of safeguards specifically for this.

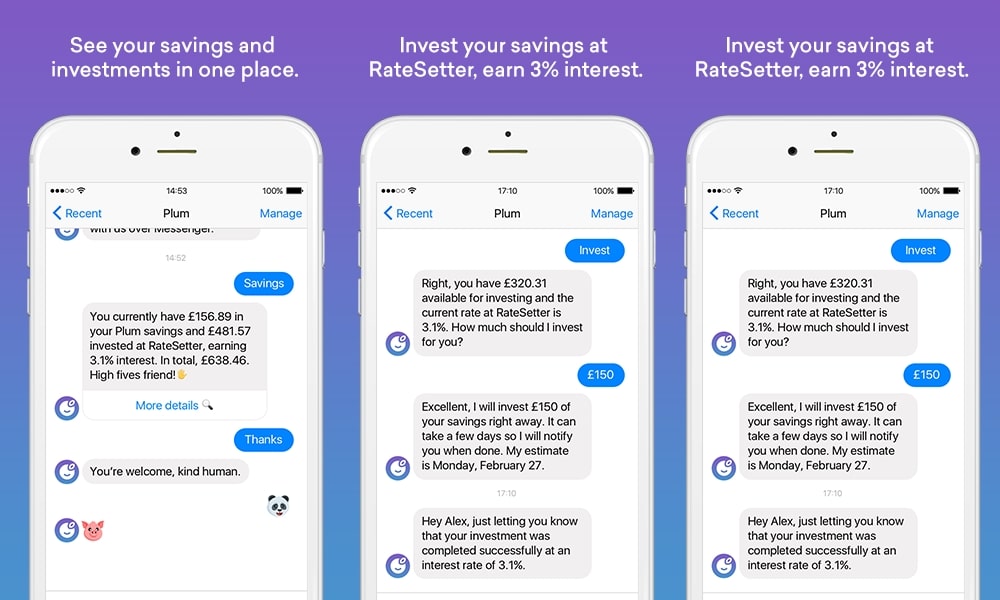

There is no interest on your Plum savings. Which means you also don’t get taxed on that cash.

If you would like to get more from a savings account, you can always invest with their partner Ratesetter, who offers 3% interest.

Samuel Jefferies, founder of moneynest.co.uk, shared a blog post on the Plum site about how he managed to save £4,973.63 in a single year.

Of course, much of Jeffries’ saving success came from taking a step back and relooking at the way he spent his money.

He renegotiated his rent, changed car insurance, started doing smarter food shopping, cycled to work and switched to a Sim-only phone contract.

Plus, he set up an account with Plum to save a little each month.

“Plum started saving little amounts automatically every few days and kept the savings in a secondary account, which you won’t be tempted to spend from. The best thing is that Plum adapts to your spending habits, so you can carry on living your life, Plum smartly adjusts,” he writes.

Jeffries and his girlfriend managed to save dramatically and fulfilled their dream of setting off on a 4-month backpacking trip around Europe.

It sounds like Plum is worth looking into.