Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Updated 4th April 2024

Trying to get on top of your overall expenses means it’s easy to forget the little costs along the way. This budgeting checklist will help you break down your expenses into chunks, so that you can make a realistic household budget – and see where you can save.

Making a budget is a great way to get started with your savings safety net. When you understand your spending habits, it’s much easier to see where you can cut back or change your approach to save money. It doesn’t mean you’ll need to live a frugal life, either! This budgeting checklist is designed to help you see where you can change things, like your household bills, without feeling like you’re cutting anything out of your life.

Use this budgeting checklist to remember all of the little things you spend on each year. It’s easy to forget the costs that come around annually or quarterly, and they can surprise you – leaving you without a savings safety net. Set up a savings account and start sweeping those extra bits of cash away, too!

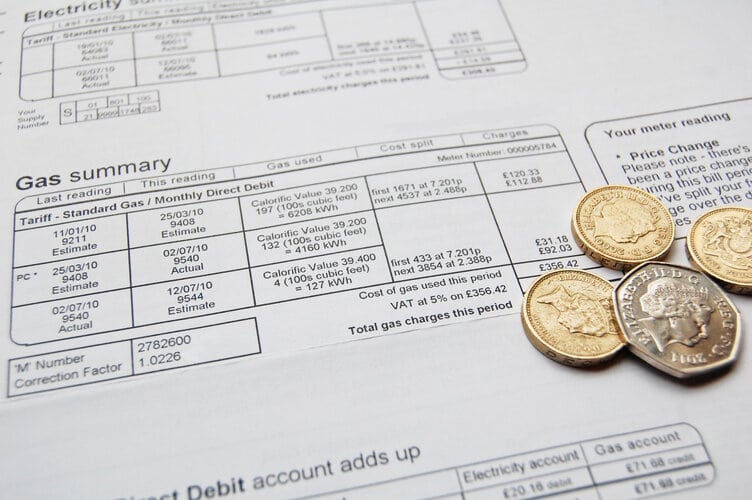

The most boring, but essential, expenses you’ll need to cover. Make a note if you pay annually or monthly for each – some could be much cheaper if you can afford to pay in one annual lump sum (such as insurance).

List your expenses for:

Make a note of the annual renewal date for your bills, too. This will help you shop around and compare prices in time to nab a better deal to save money in the future.

It’s a tedious process we know, but shopping around each year could save you thousands of pounds over a lifetime – which means extra cash in your pocket for investing!

We’re living in an increasingly subscription-based world, so now’s a good time to review everything you’re spending on digital and physical memberships.

List your monthly costs for:

Take a look at where you may be able to save. Could you, for example, ask your partner or housemate to sign up to one of the services you have (but they don’t) to share, taking advantage of any new customer free trial deals? Perhaps you’re inadvertently paying for a subscription you no longer use (gyms, we’re looking at you). Or, you may find someone in your household also has the same subscription that can be shared, such as Amazon Prime or Spotify Family.

With similar services, such as TV streaming, think about which ones you use the most. Are there any you could drop for a while? Rotating across services helps you save money and also means when you’ve ‘completed Netflix’ there’s a whole new array of choices on a different service to choose from!

Go back through your bank statement from the last six months (ideally a year). It’s tedious, but trust us – you’ll be amazed how much it adds up here! Tot up everything you’ve spent in a grocery store, on takeaways, and dinners out. Next, look at what you’ve spent in stores like Boots and Superdrug, or what you’d normally spend on things like toothpaste, hair products, grooming products, and makeup and accessories.

Finally, consider what you’ve been spending on clothes. School uniforms add up quickly – if your school offers a uniform swap each year, this could save a lot of cash. We’ve all spent a lot more time in leisurewear the past year, too – but as the world reopens, our wardrobe needs checking out. Empty your wardrobe and drawers of all items of clothing and shoes, including those winter jackets you store in the attic.

Decide which ones you can donate to charity, which are unworn and easy to sell, and which ones need repairing. Doing this will help you see what’s already there – and possibly make you some extra cash while you’re at it! Make a list of items of clothing you think you’ll buy in the next six months, and how much you’ll need to spend on them. This will give you a better idea of your clothing budget.

Even when you’re an NHS patient, you’ll usually need to pay for the dentist and optician. You’re supposed to have a checkup at the dentist each year – when did you last go? Look online at your local practice to see how much a checkup will cost – it’s usually around £27 unless you need extra treatment. NHS costs are listed here. There is a crisis with NHS dentists right now, so you might need to scout around to find your nearest practice taking on patients.

If you need to wear glasses to use a computer screen for work, your employer may be able to cover the cost of an annual eye test. Anyone on a low income in receipt of benefits like Universal Credit can also access cheap or free optical care (not including contact lenses). This includes vouchers to cover some or all of the cost of a new pair of glasses. You can often purchase glasses with these vouchers in two-for-one deals, too. Find out if you’re eligible for a free eye test on the NHS – it could save you a ton of cash.

Don’t qualify for free eyecare? Factor in how much an eye exam, contact lens checkup, and new pair of glasses will set you back each year. Try to get your eyes checked every year – opticians can spot some health issues long before they become an obvious problem! Keep an eye out for things like eye test vouchers or discounts – you could bag a bargain if you find a free eye test voucher and take the prescription to shop online for cheap glasses, too.

The cost of fuel has remained fairly steady in recent years – steadily high! The free RAC app has a fuel finder in it – helping you find the cheapest petrol or diesel wherever you are in the UK.

Think about and list your costs for:

There are some ways to save on these costs. For example, you may not need a full season ticket for your train fare if you work from home some of the week. Could you cycle to work instead of drive? Perhaps you can ride share with a local colleague, or find others who live and work in the same places as you on rideshare apps like BlaBlaCar. If you park your car on the street at home, look for resident parking schemes for discounts.

If you hardly use your car at all these days, consider if it’s worth keeping at all. You could be paying out for an expensive driveway ornament! Think about your typical journeys and how much alternatives could cost. For example, if you only drive to the grocery shop, look at the equivalent of fortnightly deliveries instead (with a walk to the local corner shop for basics like milk). It could be far more cost-effective for you to join a car club or rent a car for special journeys instead of paying the regular tax, fuel, insurance, and maintenance every month.

We’re all dreaming of getting away after more than a year of lockdown!

When adding up your holiday costs, think about:

It’s easy to see how a holiday quickly adds up! There are alternatives to expensive international vacations if you’re stretched for cash at the moment. If you already have (or can borrow) the equipment, camping is always a great way to holiday on a budget.

Choosing the right time of year can save you hundreds or even thousands of pounds, too! It’s more difficult for families with children, as the off-peak seasons tend to be outside of school holiday times. However, even the day of the week that you fly or take a ferry can impact the cost of your tickets, so it’s worth looking at flexible dates before you book anything to see how much you could save.

Self-catered accommodation is cheaper than a hotel or a package deal, but make sure you’re able to make your own meals with ease (i.e., that it has a fully equipped kitchen!). Check the average price of groceries, too – some places can be VERY expensive when it comes to buying food, which means self-catered might not be the cheapest option.

From outdoor sports to going to concerts, or meals out with the family and a game of ten pin bowling to finish, there are many ways we spend on leisure.

Think about your leisure costs, such as:

There are ways to save on many leisure expenses. Two-for-one deals on cinema tickets, for example, will help you keep costs down. You might also be able to buy a ten-swim pass or similar at your local leisure centre, to reduce the cost of regular sports activities.

Try to split day trip costs with friends and family, too. If you’re all going by car, try to share lifts wherever you can – and take a picnic instead of buying food at a cafe. If you regularly travel as a pair or family by train, look into railcards to save up to 30% on rail fares.

Keep an eye on local online noticeboards and newsletters for deals, too. You could nab free or cheap theatre tickets, or attend a free art gallery exhibition with a free glass of champagne, you never know!

Now you’ve listed out your annual costs with our budget checklist, take a long, hard look at it. What could you do without? What could you minimise to save money on? Is there anything – like energy bills – that you could reduce with just an afternoon of research?

This helps you slash your outgoing expenses. It also helps you spot your spending habits – you might, for example, be surprised to find out how much you spend on streaming services that you hardly use.

Work out what you could save with a few simple changes, and voila! You’ve got the start of a savings safety net. To find out what to do with it, download our FREE ebook here.