Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

When it comes to investing, there’s no one-size-fits-all. Some people like to go all-in on shares, chasing high returns with high risk. Others prefer to keep most of their money tucked away in cash or bonds, happy with lower returns if it means they can sleep at night.

But what if you’re somewhere in the middle? That’s where portfolio splits come in, and one of the most popular options for long-term investors, risk-averse investors, is the 80/20 portfolio.

So, what is an 80/20 portfolio split, how does it work, and could it be the right choice for you?

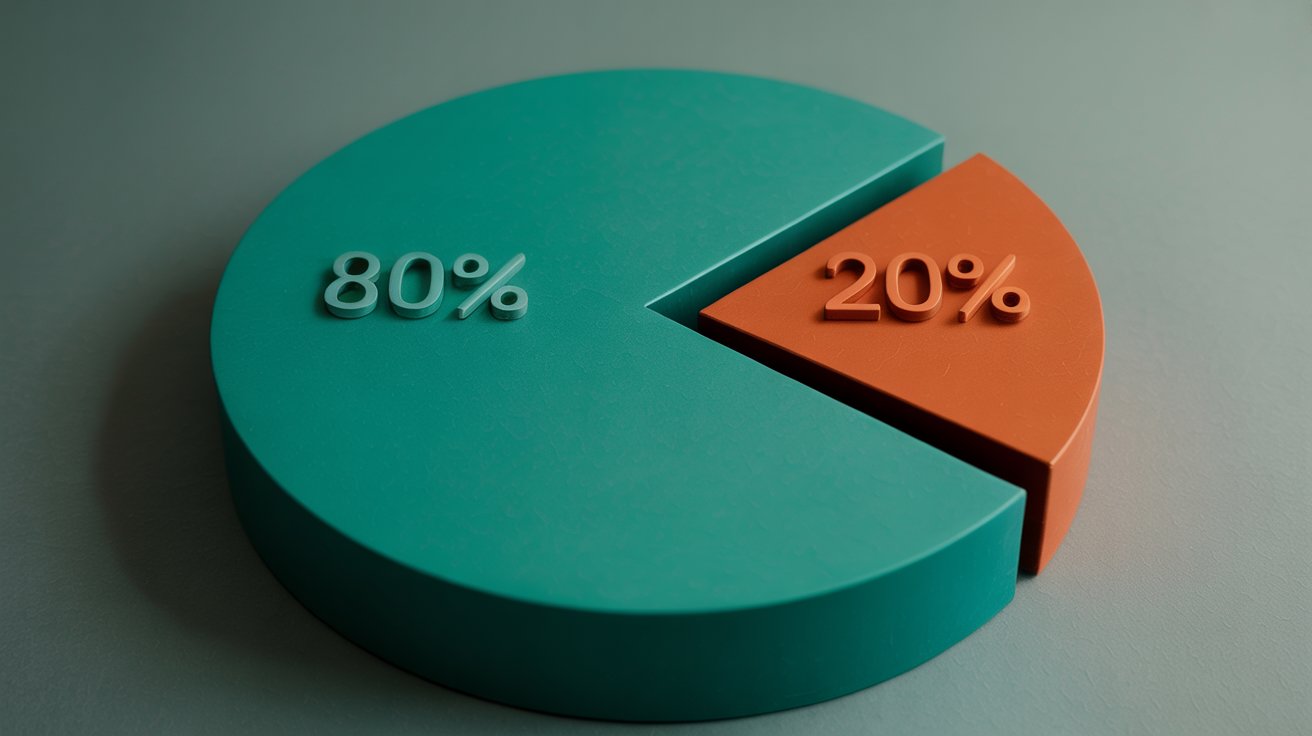

An 80/20 portfolio means putting 80% of your investments into stocks (equities) and 20% into bonds (or other fixed-income assets).

Stocks are where the growth happens, they can rise (and fall) in value, and over time they tend to outperform other asset classes. Bonds, on the other hand, offer more stability. They won’t grow your money as fast, but they can help cushion your portfolio during downturns.

The idea behind the 80/20 split is to get the best of both worlds: long-term growth with a touch of safety.

Also read: Stocks vs bonds: Where should I put my money?

This sort of portfolio is generally seen as a growth-focused strategy. It’s ideal for investors with a longer time horizon, say 10 years or more, who are willing to accept some short-term ups and downs in exchange for stronger returns in the long run.

Think of it like a seesaw. Stocks might swing more wildly, but the 20% in bonds helps keep things steady. This makes it a popular choice for people in their 30s and 40s who still have time on their side before retirement, but who don’t want to be entirely at the mercy of the stock market.

If you’re based in the UK and want to create an 80/20 portfolio, it’s easier than you might think. You can do it through an investing platform like eToro, Trading212, Interactive Investor, or NuWealth.

Here’s how to put it together:

Start by deciding how you want to split the 80% in stocks. You could go global with a fund like the Vanguard FTSE Global All Cap Index Fund, which spreads your money across thousands of companies in different countries.

Or if you want to back British businesses, the FTSE 100 or FTSE 250 index funds are easy options.

Next, the 20% in bonds. You can keep this simple with a UK government bond fund (known as gilts), or look at something broader like a global bond index fund. Many investing platforms also offer pre-mixed bond funds for different levels of risk.

Once you’ve picked your funds, just invest 80% of your money into the stock fund(s) and 20% into the bond fund(s). That’s it.

You can also automate this through a “ready-made portfolio” option on some platforms, or by using a robo-advisor that builds and manages your investments for you based on your goals and risk tolerance.

Like all things in money, it depends on your goals and mindset.

An 80/20 portfolio could be a good fit if:

You’re aiming to grow your money over the next 10+ years

You’re comfortable with some volatility in the short term

You want a balance between growth and a bit of protection

But if you’re nearing retirement or feel nervous about market dips, you might want to consider a 60/40 or even a 40/60 portfolio instead, with more bonds and less in shares.

Remember, all investing carries risk. The value of your investments can go up and down, and you could get back less than you put in. That’s why it’s so important to invest with a long-term mindset and only use money you won’t need in the immediate future.

That said, historically, a portfolio weighted heavily toward stocks has delivered strong results over time, especially when combined with regular investing and a calm approach.

An 80/20 portfolio split is a great way to stay invested in growth while giving yourself a little breathing room when markets wobble. It’s simple, well-balanced, and easy to build with index funds or ready-made investment plans.

If you’re new to investing or want to see how it compares to other strategies, have a read through some of our other investing guides, or take a look at investment platforms like NuWealth or Vanguard where you can start building your own 80/20 portfolio from just £25 a month.

After all, it’s your money, and it’s never too early (or too late) to make it work for you.

As with any type of investing, you capital is at risk. To learn more about investing, do sign up to our fortnightly MoneyMagpie Investing Newsletter. It’s free and you can unsubscribe at any time.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice.

Direct to your inbox every week

New data capture form 2023

Leave a Reply