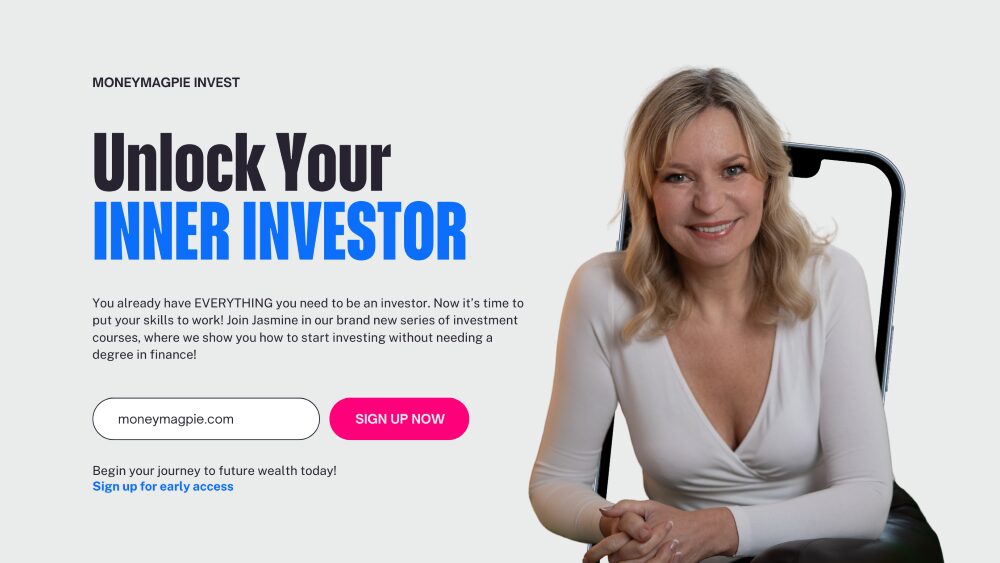

Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

The New Year always comes with pressure to do more: more saving, more investing, more financial “goals”. But here’s some good news, you don’t need a full financial overhaul to start the year feeling confident about your investments.

In fact, 20 intentional, focused minutes is often all it takes.

This isn’t about chasing hot stocks or making big, dramatic changes. It’s about clarity, intention, and starting the year in control. Let’s walk through your 20-minute New Year’s portfolio reset.

Most investing mistakes don’t happen because people check their portfolios too often.

They happen because people don’t check them at all, until markets wobble and emotions take over.

A quick reset now:

Think of it as a financial reset, not a deep spring clean.

First things first: get the full picture.

Log into your investment platforms and make a simple list of:

You’re not judging anything yet, just seeing it all in one place.

You can’t manage what you don’t look at. Many people are more invested than they realise… they just haven’t joined the dots.

Now comes the most useful part of the reset.

For each investment, ask yourself: “Would I buy this again today?”

This doesn’t mean you have to sell anything immediately. It simply highlights where you may be holding on out of habit rather than conviction.

Investing isn’t about loyalty. It’s about alignment.

Next, zoom out.

Ask yourself:

Many investors accidentally drift into imbalance over time, especially after strong market runs.

A balanced portfolio helps smooth out bumps and protects you when one area underperforms.

Finally, reconnect with your goal.

Ask:

Investments that made sense five years ago may not suit your life today, and that’s completely normal.

Your investments should support your life, not stress you out.

Small, intentional tweaks now can save you from emotional decisions later.

Most people don’t lose money because they’re bad investors. They lose money because they:

This reset puts you back in the driver’s seat, calmly, confidently, and without overwhelm.

You don’t need to start the year with bold predictions or complicated strategies.

Sometimes the smartest move is simply to:

Your future self will thank you for it!

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence. When investing your capital is at risk.

Direct to your inbox every week

New data capture form 2023

Leave a Reply