Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

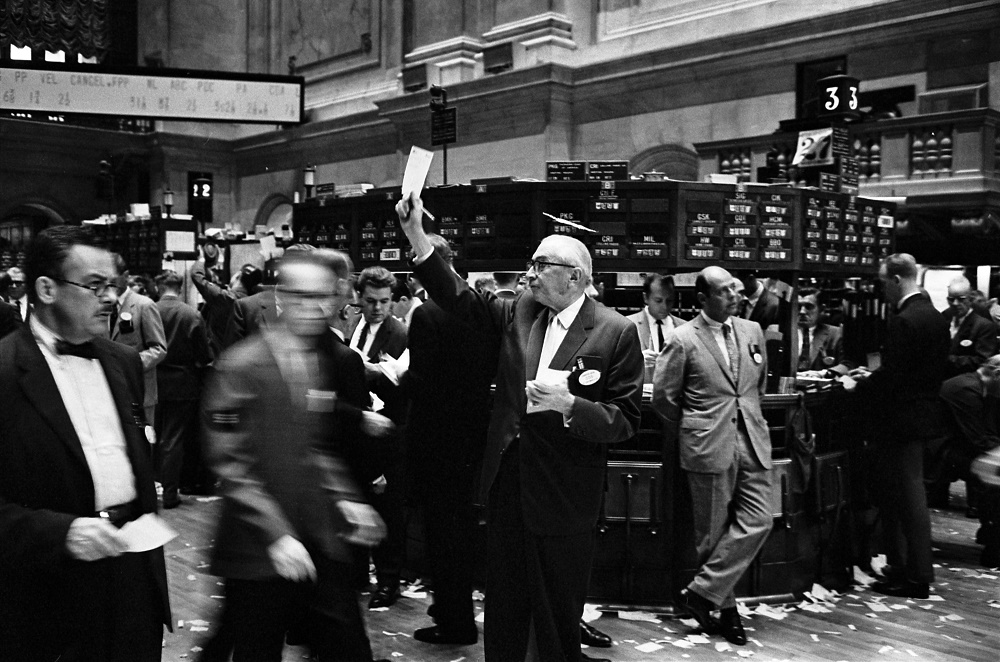

The bond market is waaay bigger than the stock market both nationally and globally. It’s where government and corporate bonds are traded.

The issuing of government bonds is the mechanism whereby central banks ‘print money’ and they’ve all been doing that in spades over the last few years. And that’s after doing it pretty energetically from 2008.

So what could happen if this bubble burst – and it is a bubble – particularly for the large institutional investors who have been effectively forced to buy bonds in their billions?

That’s the question that Tim Price, of Price Value Partners, tackled in this, the first of my new podcast series: The Tin Hat Money podcast.

Tim is an asset manager and his background is in bond trading.

Now that he manages funds for private clients, he says he has turned his back on bonds because he doesn’t trust the market. He prefers solid assets such as gold, silver, money metals generally, mining companies and commodities companies of different sorts.

He says that the exposure to debt that all the main western powers have is so extreme and so huge (particularly Japan which has around 260% debt to GDP ratio!) that it’s unsustainable and has to come crashing down at some point.

But what could that mean for your investments if you have a lot of government bonds (gilts in the UK, treasuries in the US) in your funds?

Watch my interview with Tim and see what you think.

In fact tell me on the investing Discussion Board here.

Tim says that what all the money-printing has done is to turn a financial crisis (what happened in 2008) into a Sovereign crisis. In other words, because various governments took on the debt created by banking institutions, there is now no entity large enough and rich enough to bail out the governments!

He adds that the situation now is so severe that there are three scenarios that could play out from the bond market situation – either various economies in the West grow so fast that they eat up the debt (that’s clearly not happening…even in the USA), or governments default which would bankrupt the global banking and pension fund industry because they are the main holders of government bonds, or (most likely) the governments try to inflate the debt away – in other words, they print more money. In common parlance this is called ‘kicking the can down the road’.

So effectively, you and I will pay for this because printing more money will create more inflation which will affect us, the consumers, the taxpayers. Oh joy!