Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

This is a sponsored post on behalf of Monese

We’ve written recently about the difficulties people face when trying to open bank accounts if they have a credit history that may traditionally count against them. Some customers have said the sheer amount of paperwork and ID required to open an account is daunting: proof of address, credit checks and a host of other documents. Your financial future can seem as if it’s out of your hands.

Monese don’t ask for any of the above documents. All you need is an email address, phone number and an ID document – like your passport – and there are no appointments, no phone calls, no credit checks, no minimum deposits. With the aim to help build your financial future, Monese offer an instant account opening process, which part of why they’re one of the most popular financial services in Europe today.

You can:

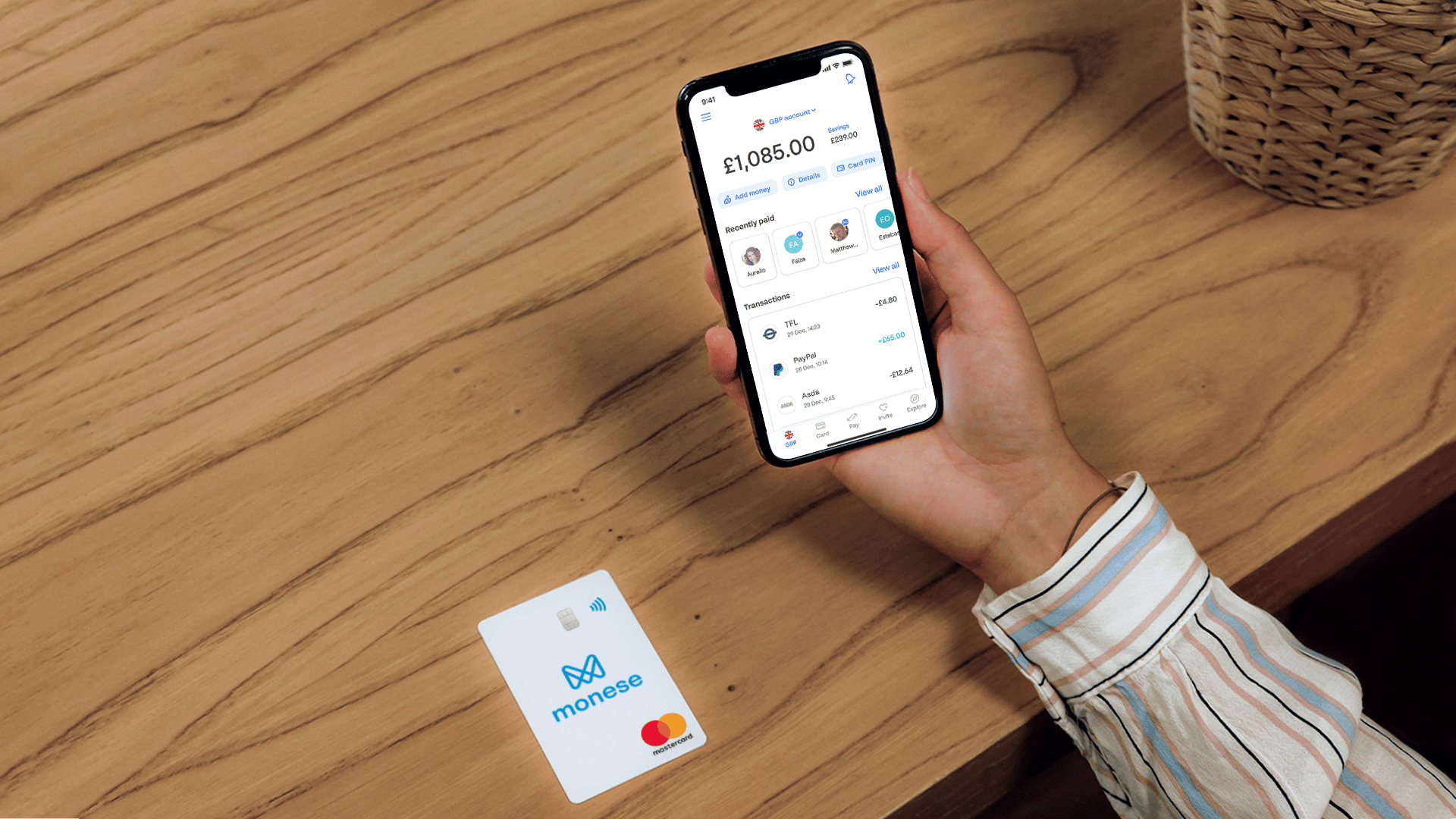

All that, plus a convenient mobile app for saving and sending money, and a contactless prepaid debit card to use worldwide. Monese offer financial freedom to foreign nationals, expats, freelancers and the unbanked, and you can open an online money account with them if you live in any of the 31 countries in the European Economic Area.

Monese are not a bank, so don’t have branches or the ability to offer traditional banking services like overdrafts and loans. They do have a multilingual support team dedicated to making your life much easier, and gaining control of your own finances without complication.

Monese founder Norris Koppel discovered just how difficult it can be to open a bank account when he moved to the UK as a foreign national, so he was well-placed to create an app that removes as many of these barriers as possible.

Founder of Monese: Norris Koppel

A Monese account is a mobile money account that allows you to spend, send and save money right from your phone. You’ll get your multi-currency account details to pay and get paid like a local, plus a contactless Mastercard debit card to use almost anywhere. Other handy features include easy cash withdrawals, great exchange rates on foreign currency spending and real-time mobile notifications.

You can create an online money account with Monese if you’re aged 18 or over and live in one of the 31 countries in the European Economic Area (EEA). You don’t need a perfect credit score, the right utility bills or a fixed income to get started.

You could be moving abroad to work, study or simply experience somewhere new. Maybe you can’t get a regular bank account or don’t want to. Whatever your situation, we’re here to help you save and spend money locally. And once you have a Monese personal account, you can open additional currency accounts or a joint account.

There’s no need to visit a branch or make time for a phone call, as the process for opening a Monese instant account could have you signed up fast from the comfort of your home or on the go.

Many customers will be keen to build their credit score, perhaps after a challenging period of time, and Monese offers customers the chance to build their credit history hassle and interest-free, with no credit checks or the need to apply for a high-interest credit card, with the Monese Credit Builder, available on all plans for customers in the UK.

*Representative APR: The loan, as a part of the Credit Builder service is a 0% interest loan, but in financial jargon the £7.95/month subscription fee relates to a 28.2% APR as that is the cost of your Credit Builder. This is based on a loan amount of £600.

The Monese Credit Builder is set up so you can save money while building your credit history. After a year of monthly repayments on your interest-free Credit Builder loan, you’ll have 12 months of successful repayment history recorded with the credit agencies, plus 12 months of savings ready to spend. So you can rest easy knowing that your monthly repayments are reported to all three of the UK’s main credit agencies: Experian, Equifax and TransUnion, where you’ll start seeing a difference in your credit score.

And with Monese Boost, you can choose past card transactions up to £300 to pay back in monthly instalments. This feature unlocks after your 4th Credit Builder payment, and helps grow your credit score even more quickly.

Another bonus offered by Monese is their insurance cover, which offers you built-in protection over your bills and purchases (including electronic devices) from the day you join, with the level of cover depending on which plan you choose. The best part is you don’t need to do anything extra: once you’ve signed up for one of Monese’s paid plans, your insurance cover will start today.

If you can’t work because you’re sick, have an accident, lose your job or need to stay in hospital, you don’t need to worry about falling behind on your bills either, as Bills Protection will give you peace of mind and help you cover bills you usually pay from your Monese account. The level of cover will depend on which plan you choose, and is offered on the Classic and Premium accounts.

Start by downloading the free Monese mobile app from the App Store, Google Play or AppGallery. Once it’s installed, all you need to open an online money account is:

Once you’ve recorded your short video selfie in the app to confirm your identity, you can choose your Monese plan and tell them where to send your card: Monese do still need to verify a UK address to help them send your physical card to the right place. You can do this by granting access to your geolocation while using your Monese app.

Once you’ve gone through the instant account opening process and verified your address, you’ll have full access to your Monese account allowing you to add, receive, send and withdraw your money instantly, whenever you need to. You can even create a virtual card and connect it to Apple Pay or Google Pay for in-store and online payments while you wait for your physical card to arrive.

Some banks need a minimum initial deposit to open an account. You can create an online money account for free with Monese then add money when you’re ready.

There are lots of different ways to add to your balance, too:

If you’re ordering a physical card from the Monese starter plan, this is currently free until the end of November 2022, after which time you may need to top up your account with enough money to cover the £4.95 card delivery fee.

Monese have signed up millions of people from across 31 countries. With 70% of incoming customer money coming from salary payments, they have fast become one of the most popular and trusted financial services across Europe, and aim to improve the lives of customers that traditional banks may have failed to help. Monese help you build your financial future.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.