Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

£1,000,000. Looks good doesn’t it?

While it may seem a colossal sum, building a seven figure investment pot is actually quite achievable for the average investor.

In this article we’re going to explain how, with a touch of luck, it’s possible to turn £1,000 into a cool £1 million through the art of patience and discipline. Keep on reading for all the details or click on a link to head straight to a section…

If you’re just starting out, the thought of having a seven figure sum in your investment portfolio may seem a tad unrealistic. Yet, sit down to do the sums and you’ll discover that becoming a millionaire investor may not be as ambitious as it seems.

Before we dive into the details, it’s worth knowing that all investing carries risk.

As we know, the value of investments can rise and fall, so there’s no sure fire way of making a million when it comes to putting your faith in the stock market. That said, if you’re comfortable with a dose of risk, happy to invest for a long time, and you’ve the mental strength to stick with an investing strategy over a long period – including through the bad times – then read on to discover how the average, non-expert, investor can, with a stroke of luck, build up a £1m portfolio.

If you like the thought of having £1m worth of investments in your name, then here are 5 factors that you should pay very close attention to.

Let’s get the worst one out of the way: Age.

If you’re relatively young, you obviously have longer to build up your investment pot than an older investor. This means if you’re still in your 20s, you’ll probably need to save less per month compared to an investor who starts investing in their 40s.

That being said, if you are in your 40s and you haven’t seriously started to invest, then it is still possible to build up a £1m investment pot in future – you’ll just have to work harder than investors who started in their 20s or 30s (more on this below).

Regardless of your age, building up a £1m investment pot will require you to put a decent chunk of your monthly earnings into your general investment account or stocks and shares ISA. This doesn’t necessarily mean you need to be earning big bucks, but it does mean that you’ll need to have the financial ability to re-direct a proportion of your regular income into your investments.

Remember, investing for the future is a form of delayed gratification.

Of course, give the current cost of living, not everyone has the luxury of being able to save or invest right now. If that’s you, then thinking about becoming a millionaire investor is probably unrealistic for the time being.

Make no bones about it, becoming a millionaire investor is a marathon not a sprint. That is why, if you want a seven figure portfolio, you’ll need to be thinking about passively investing over a number of decades.

In layman’s terms, passive investing means you keep on investing the same amount each month, regardless of recent stock market performance.

Quite frankly, if you aren’t patient, or you’d be tempted to make changes to your investments based on market performance, then you probably shouldn’t be targeting a £1m portfolio.

This is a big one. Fees charged by investment brokers are often unavoidable. Yet this doesn’t mean you needn’t to pay close attention to them. Fees changed by providers can vary a lot so it’s important to choose a broker that best suits your investment style. Don’t choose a high-cost broker with a big name just for the sake of it as high fees can eat into your returns.

It’s worth knowing that many passive investors will go with a provider with low platform fees (especially as many passive investors will opt for an index-tracker fund or ETF, which can make it easier to find cheaper fees). For more on this see our article that discusses share dealing fees vs platform fees.

One of the biggest factors that will determine whether or not you can become a millionaire is one you can’t control – luck. That’s because if you ever hit the £1 million investment milestone, it’s very probable that you’ll have enjoyed a decent return on your portfolio.

This doesn’t necessarily mean you’ll need to have achieved double-digit returns over many decades. It does, however, mean that you’ll probably need to have enjoyed a decent ‘average annualised return.’

For example, the average return of the FTSE 100 over the past 20 years has been 6.89%, so anything like this kind of performance is likely to put you in good stead, especially when you take into the account the magic of compound interest which can accelerate returns and ultimately help to boost the value of your portfolio.

Now we’ve explained some important factors that may determine whether you’ll become a millionaire investor, let’s explore the sums on how to hit that illustrious £1m target.

First things first, it almost goes without saying but the more you start with, then the easier it will be to build up you investment portfolio. However, for the purposes of this example, we’re not going to make it too too easy for ourselves.

Here are some modest assumptions we’ve made:

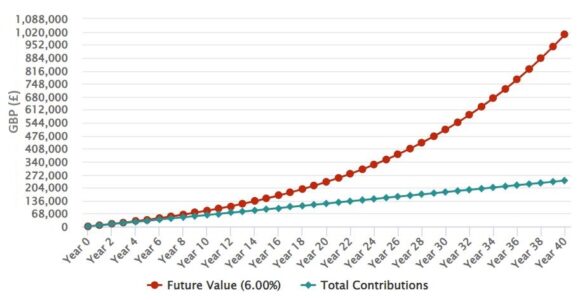

Taking into account the assumptions above, if our example investor puts £500 into their portfolio every month for 40 years, then he/she would have amassed a total of £1,006,702 by the time they’re 65 years old.

This is quite a remarkable sum when you take into account the fact this investor would have invested just £241,000 of their own money. A whopping £765,702 is the profit from the 6% average annual return over 40-years, plus the impact of compound interest.

Here’s an illustration of what it looks like:

As we say, being an older investor and targeting a million shouldn’t be frowned upon. However, there’s no denying the fact that older investors will have to contribute a lot more to have a chance of hitting the seven figure mark by their mid-60s.

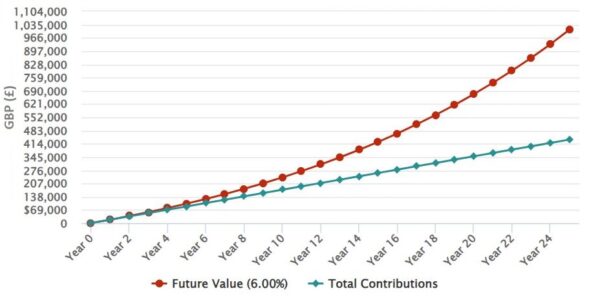

Take a 40-year old for example. He/she would have to contribute a hefty £1,450 every month to their portfolio in order to achieve a similar investment pot (£1,009,306) by the time they reach 65. This figure assumes the same annual return of 6%, and a starting pot of £1,000.

Of this seven figure sum, £436,000 would have been contributed by the investor, with £573,306 coming from market returns.

Here’s another illustration:

So, as you can see, while it’s possible for a 40-year old investor to reach £1m within a shorter 25 year time horizon, it’s much, much harder. This is why it’s worth investing as early as you can, as younger investors have the benefit of time on their side.

Now we’ve explained how to amass a £1 million investment portfolio – in theory, at least – you may be wondering about having a £1 million pension pot.

Well for most, this may actually be easier to achieve for two reasons. Let’s take a look…

Firstly, private pension contributions come from pre-tax income, meaning anything you pay into your pension is shielded from the taxman. For basic-rate taxpayers this represents a saving of 20%. For higher-rate payers it’s 40%.

And while you may have to pay tax on your pension when you come to access it, don’t forget that current pension rules allow you to take 25% of your pension pot tax-free once you reach 55 years old – though this is rising to 57 in April 2028.

If you’re an employee with a private pension then you’re probably automatically enrolled in a workplace pension. This is a scheme where your employer is obliged to top-up your personal pension contributions.

The minimum total auto-enrolment contribution is 8%, and at least 3% of this must come from your employer. The rest must come from you, though your contribution comes from your pre-tax salary.

Again, this tax advantage, plus the ‘free’ contributions from your employer, is another reason why it can be easier to accrue £1m in a private pension pot compared to having a million stashed away in a general investment account or stocks and shares ISA.

Pensions is a complex topic. To learn more do take a look at our article that explains all you need to know about pensions.

Are you keen to learn about investing? Sign up for our fortnightly MoneyMagpie Investing Newsletter.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.

When investing your capital is at risk. Remember, the value of any investment can both rise and fall.