Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Rob Gardner, Money Expert and Author of Best-selling Personal Finance Book FR££DOM, says Be Like Amundsen with Five Steps to Plan for your Pension.

The age-old question ‘How much money do I need to retire?’ is perhaps the most important question you should be asking yourself about your finances, yet one in three UK adults don’t know how big a pension pot they’ll need, and one in five don’t even know how much they have*.

In a financial landscape where pension planning and considering what kind of retirement you’d like seem like distant summits to reach, it’s unsurprising that seven in ten individuals lack a clear retirement plan, including savings and investments, and only three in ten feel confident about achieving financial freedom. Like an Antarctic expedition, setting aside enough money to build a pension pot that will see you comfortably through your retirement can feel very dauting – the ‘final frontier’ of financial planning – so it might not surprise you to consider that the two aren’t really poles apart.

The story of Amundsen and Scott’s race to the South Pole offers us a relevant insight into how we should look after our finances. When Scott, a Naval officer, and Amundsen, an explorer, set off on their expeditions to the South Pole they left at the same time, but they went about it in very different ways.

While saving for your future might not be as dramatic as an expedition to the South Pole, it has many of the same features. For example, just a quarter of UK adults are confident in their retirement plan, but mapping out a careful plan is essential. Unexpected setbacks and bumps in the road should be expected, and you will need to seek guidance along the way. However, what both feats have most in common is that success is best achieved with small steps, taken consistently, over a planned timeframe, like saving every year in a sustainable and disciplined way. Remember, slow and steady wins the race.

Amundsen had wanted to be an Antarctic explorer from a very young age and apparently as a boy he’d slept with the windows open every night so that his body would get used to the cold. He went to live with the Innuits before he started his expedition and learned how to live in the freezing cold. He looked at how they used sleds and dogs, he looked at the furs they wore, and he trained both himself and his men to eat raw fish. He took only a very lightweight but well-equipped team with him.

Most importantly though, Amundsen had a plan that he stuck to. He knew he had to cover 1000 miles and decided that he was going to travel 12 miles every day. Whether it was good weather or bad, he would stick to the 12 miles and not deviate from the plan.

Scott on the other hand, acted very differently. Instead of taking dogs and sleds, he took mechanical snow machines which looked impressive but had never been tested in Antarctic conditions. He also took ponies, which are not designed for moving in snow, and masses and masses of supplies.

Scott didn’t have a plan and so on a good day when the weather was fine, he would cover 40 miles but, on a day when the weather was bad, they would all stay in their tents and Scott would write his diary. Their progress was haphazard, and Scott’s men ended up exhausted from trying to do too many miles in a single day and not having enough time to rest.

So how does this story relate to financial wellbeing? Well, it’s clear that Amundsen had a plan and travelling 12 miles a day every day was a big part of his success. He chose a more sustainable method of taking smaller steps, consistently and over time, to hit his goal. The incredible thing with Amundsen is that he travelled all the way to the South pole and got back on the exact day he predicted he would. Scott got to the South Pole late and he and all his men died on the way back.

Here’s how you can apply the #AmundsenMethod to saving for your pension, in five steps:

If you knew you were going to live to 100, would you save more money? The average man runs out of money 10 years before he dies, and woman 12.5 years** so you need to regularly check how much is in your pension. A good rule of thumb is to have a pot worth ten times your annual salary by the time you retire, which sounds like a lot, but is achievable by starting early and breaking it down into simple steps.

By the end of your 30s, you should aim to have a pot that’s equal to three times your annual salary. At this time of life, you may be tempted to postpone pension saving – especially if you have kids and a mortgage. But if, like Amundsen, you don’t deviate from your route and have the discipline to stick to your savings plan, you will have more chance of creating your dream retirement.

In your 40s your savings goal should be six times your annual salary by the time you turn 50. Earnings often peak in this decade, giving you the opportunity to take advantage of greater financial resources to make bigger strides towards your retirement target.

Having a clear financial plan is not enough. Before you set off on your money saving expedition, you need that base layer of financial resilience in place which you will build on over the course of your lifetime, setting you up for when you stop work.

Those bumps in the road ahead are in fact, the road, so we need to be financially and mentally equipped to deal with these setbacks and the simple solution is to be prepared for the unexpected, by creating a separate ‘emergency fund’. This is not a savings pot for long-term goals. As cliché as it sounds, it’s your ‘rainy day’ fund.

If this already feels challenging, don’t worry – you’re on the same page as more than half of UK adults – who don’t have an emergency savings pot. However, getting into the habit of saving is simpler than you may think with a few lifestyle adjustments. Unlike Amundsen, temporary lifestyle adjustments won’t be as extreme as training your body to survive on raw fish; but like so many of us have become accustomed to since the pandemic, a couple of cut-backs like eating out less, pausing your gym membership or cancelling a subscription or two that you could live without – Netflix or Amazon Prime – you can build up a cash buffer quickly, to help build resilience and deal with setbacks on your money-saving expedition.

With a plan in place and your emergency fund topped up to ensure you can weather the storms on the expedition ahead, you’re ready to set off on your journey. For a comfortable retirement, you want to be putting away 15-20% of your salary, which at first glance can feel like a challenge of Antarctic-expedition-proportions, but if you think like Amundsen, you’ll be pleased to know that this is achievable with one small step – or change in behavior – done consistently, over decades, like swapping what you’d spend on your daily coffee bought on the way to work, which can make a latte difference to your future self.

Contributing £100/month to your pension (roughly your daily coffee habit), including NI equates to an annual personal pension contribution of £1,320, or £13,200 over a decade – or £20,000 if invested with the long-term in mind. If you are a high-rate taxpayer, the benefit is even greater.

Keep up this good habit over a 40-year career and through the magic of compound interest and tax relief, that £20,000 could grow to over £300,000.

Unless you’re an experienced polar explorer, setting off on your expedition with a guide is a far better idea than going it alone. Amundsen succeeded in his mission to the South Pole because he went to live with the Innuits. He learned from them and followed what they did when making his own journey.

It’s important that you also go and find an Innuit and learn how to manage your financial journey, which is particularly important once you’ve hit retirement and are no longer earning. If you’ve got a company pension, you’ve retired and discovered that you have a lot of money, then you really need to get some guidance to help you understand how long you might live for, what might happen to inflation and how much you can afford to take out of your pension pot each year.

Think about how Amundsen approached his expedition: Even with the destination in sight and on his return home, he didn’t speed up or get carried away, he stuck to the same number of miles per day. You need to plan your return journey in the same way you mapped the route to your destination. Seeking out expert help will help you to review, plan and adjust to your changing financial situation to ensure you live prosperously after you retire.

Without a guide, you risk running out of money before you die which will have grave consequences for you and your family. The financial planning equivalent is Amundsen following what he had learned from the experts – in his case, the Innuits – meaning he not only reached the destination but was able to safely and steadily make the return journey home, i.e., your rate of spending once you stop earning.

Did you know your money can be a force for good? Money makes the world go round and when you invest in your pension, you are investing alongside side millions of other people. This amounts to billions of pounds. Your pension is being invested in companies around the world and how these businesses behave has a huge impact on the wellbeing of our planet.

Investing your pension in a sustainable and responsible way is 27 times more impactful for the environment than flying less, eating less red meat, or cycling to work. So, for a comfortable retirement in a world worth living in, be a good explorer and leave the path in a way that future generations would like to find it, by asking your HR department how your pension provider invests your money, and if they’re not already, ask that they invest it responsibly.

So, what can we take away from applying #TheAmundsenMethod to financial planning?

Successful pension planning is more about taking a long-term approach to your goal and is less about the external factors – how much you earn and the challenges you face on your route – and more about how you respond to these challenges, all of which of course is easier when you’re planned and prepared.

Scott and Amundsen experienced the same weather, the same terrain, and the same challenging external conditions; but in the end, it was the decisions they made, in extreme polar conditions, that led to their success or failure.

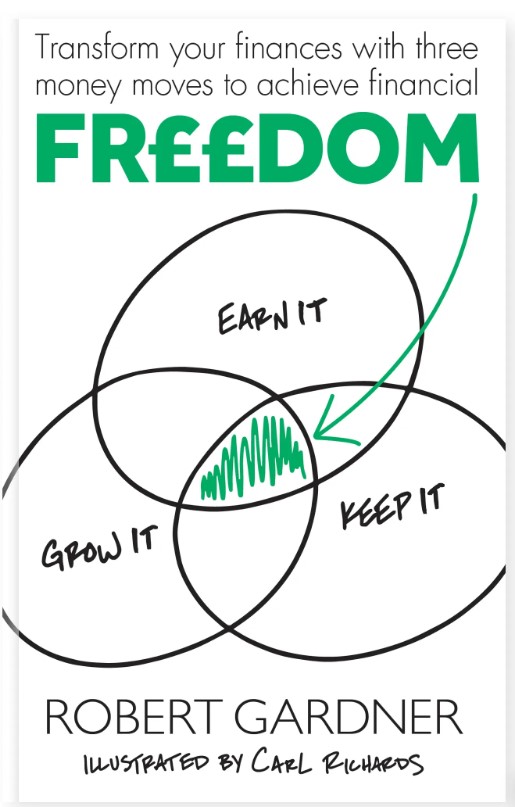

The Amundsen Method is inspired by a chapter in Rob Gardner’s personal finance book FR££DOM – Earn It, Keep It, Grow It, which launched in July 2023 and is already an Amazon bestseller.

Packed with practical advice and actionable strategies and supported with illustrations by New York Times Columnist Carl Richards, money activist and financial expert Rob Gardner brings his extensive industry experience and passion for empowering individuals to achieve financial freedom in a world worth living in.

FR££DOM aims to empower readers to take control of their finances, achieve financial freedom, and how to use their money to have a positive impact on the planet. Proceeds to the author from every sale will go to RedSTART, the financial education charity Rob co-founded. £16.99 available via Amazon.

This 18-chapter book is arranged within four comprehensive sections – ‘Earn It, Keep It, Grow It, and Preserve It’ – taking readers on a journey to long-term financial freedom. Throughout the book, readers will also learn how to make their money a force for good; understanding how they grow their money can help create a prosperous and sustainable future for people and our planet.

‘FR££DOM: Earn It, Keep It, Grow It’ is available Amazon and has been published by Rethink Press, 2023.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.