Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

On Friday 6th May, we produced a short cost of living survey via social media, asking our followers their thoughts and feelings about inflation, rising costs and more.

The survey contained a mixture of polls and open-ended questions, where we asked you to share your own thoughts and feelings on certain topics.

Here’s what we found in our cost of living survey

The first question on our survey was a poll, asking ‘Do you worry about rising energy bills?’

Just 3% of readers responded that they ‘never’ worry about rising energy bills. Unsurprisingly, however, over half (51%) of respondents said they worry a lot of the time. 33% of respondents voted for ‘Yes, some of the time’, and 13% suggested they worry sometimes, but not often.

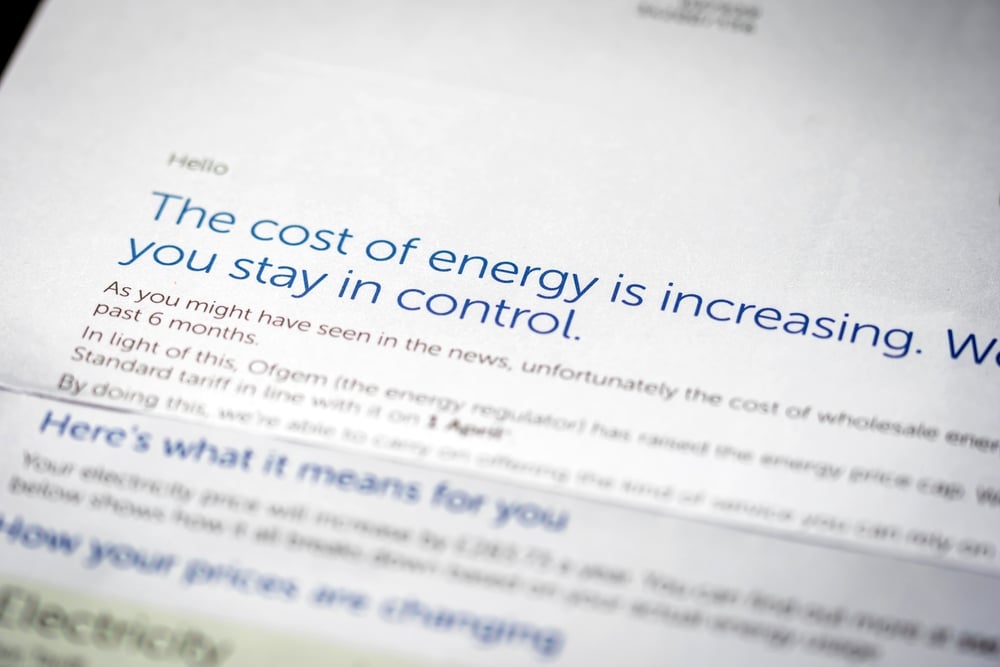

From April, the energy price cap rose by £693, resulting in energy bills increasing by as much as 50% for many. With prices set to rise again in October, it is no surprise that over half of those who took part in the survey worry a lot of the time.

If you are worried about paying your energy bills, here are some of the steps you can take to get help.

The second question, ‘Are you worried about inflation?’, was another poll. This allowed us to see the percentage of respondents who were either ‘very worried’, ‘fairly worried’, ‘not too worried’, or ‘not at all worried’ about inflation.

As expected, a large proportion of respondents said they were ‘very worried’ about inflation. 60% of people who responded said they were very worried, and 30% said they were fairly worried. Just 9% of those asked said they were ‘not too worried’, and only 1% of respondents said they were not at all worried about inflation.

Inflation rates in the UK have hit a 30-year high, causing price prices on goods and services and causing strain to many. According to the current Consumer Prices Index (CPI), inflation stands at around 7% currently, far above the Bank of England’s goal of 2%.

Our founder Jasmine Birtles, believes the actual figure may be even higher, suggesting; “Inflation rates are well into doubles figures, and have been for a few months.” You can watch her full discussion here.

Our third question garnered some interesting responses from our readers. An overwhelming worry, it seems, are rising bills. ‘Energy bills’, ‘household bills’ and ‘the council tax bill’ were the most common answers to this question. One respondent even suggested they were worried about ‘being able to put the heating on in colder months.’

The second most common responses were those centred around mortgages. People both worried about paying their current mortgage rates and saving for a future mortgage sent in answers. “I will not be able to buy a house at this rate!”, responded one reader. “House prices”, responded another, with two more people responding, ‘Saving for a deposit,” and “Saving up enough for a mortgage”.

Those who currently have a mortgage and make payments responded their payments were a big worry for them. ‘Wanting to move home and buy a bigger house’, was one readers’ biggest financial worry in the coming year.

Not being able to get out of debt and trying to afford childcare were also common worries faced by respondents.

If you are facing debt, we have lots of information about finding free debt help and we also provide free debt help directly to your inbox. You can sign up here.

We then asked our followers whether they have had to cut back on any spending in order to save money. Most respondents claimed yes, they have had to cut back on non-essential spending. Two respondents suggested they hadn’t yet made changes, but expected to in the future, with one answering; “Not yet, but will when my fixed rate on gas and electricity ends”.

Many respondents suggested they have cut back on non-essential spending by cancelling subscriptions to streaming services and memberships. “I deleted two streaming services and I cancelled my gym membership,” comments one reader. “I got rid of Netflix,” responds another, with many other replying they had done the same.

Many people replied with answers centring around reducing food shop spending. Moving to own brand food items, trying to make cheaper meals and having less meals out was a common theme amongst the responses given.

Some readers suggested they are monitoring their expenditure closer than ever and have made sacrifices to ensure they can pay their bills. These sacrifices include no holidays, not putting the heating on and selling their car.

This question was another open-ended question, allowing respondents to reply however they wished. Some of the responses were similar to the previous question, suggesting cutting down on the quantity of food being bought when grocery shopping, cancelling subscriptions and no longer buying takeaways.

Many people also told us of how they were focusing more on their spending and checking their bank accounts more often. “ switched to a better bank for my spending, changed savings accounts and started investing,” replies on follower. “ checking my bank account more”, responds another.

Most replies discussed becoming more mindful of spending, focusing more on saving, budgeting more and actively trying to spend less. “I am scared to spend unnecessarily,” remarks one reader. “I am more anxious to spend and feel guilty when I do,” another replied.

This question was another poll, and the results were shocking. A staggering 78% of respondents said they had seen a decrease in their disposable income – over three quarters. 11% said they weren’t sure if there had been a change.

Just 7% of respondents suggested they had actually seen an increase in their disposable income, and only 4% said there had been no change.

If your disposable income has decreased and you need some extra cash, we have loads of useful articles and information about side hustles, making money, saving money and more. We also have loads of help about managing your money, from budgeting to getting the best savings account.

Another poll question asked respondents whether they could cope with rising living costs, with answer options of ‘yes, easily’, ‘yes, but it’ll be hard’, ‘I will struggle’ and ‘I won’t cope’.

Over half (53%) of respondents suggested they would be able to cope, but that it would be hard for them. Following behind with 33% of the votes was the answer ‘I will struggle’. A third of those who responded are going to struggle with the rising costs of living – a stark reminder of the impacts of rising inflation, interest rates, national insurance, council tax bills, energy costs, fuel and food prices, and more.

7% of those who responded said they would easily cope with the rising living costs. The same number of respondents said they won’t cope at all with these rising costs.

If you are struggling to cope in these hard times, check out our hardship grant roundup for May. We collect all of the grants available to help those in need, so click here to see if you are eligible. We also have a huge list of all the things you can receive financial help for.

When it comes to rising living costs, we decided to ask our readers whether they had any monetary savings behind them to help them through these tough times. The results were as follows.

Over half of those who responded (56%) suggested they had a small amount of savings, and 7% said they had enough to be covered for everyday price rises and inflation increases. 22% of respondents said they didn’t have much in the way of savings, and 15% suggested they had no savings at all.

These are worrying statistics, showing just over one third of respondents (37%) have little to no savings to help with everyday living, in a time when the cost of living is the highest it has been in decades.

If you are struggling, check out the hardship grants available. We also have loads of useful information about banking and savings. We have plenty of articles about getting debt help too.

We finished the survey with the option to leave a written response. “People aren’t living at the minute, we are barely surviving, and this is just the start,” responded one reader. Another wrote, “ worried about those who won’t cope.”

Do you have any comments or thoughts on the questions asked and the responses given to the cost of living survey? Feel free to let us know in the comments below.

**All responses are anonymous. Results are representative of the 302 people who responded to our survey.**