Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Mortgage free by 33. We have some fantastic readers who share with us their money tips and tricks from time to time, so we thought we’d ask one reader, Hannah Pears, how she learned how to manage her finances and what her top tips are for being frugal and financially healthy, particularly when dealing with homes and properties.

Heather, now 30, has a wealth of experience as an interior designer and property investor, and shares her wisdom on how to face the current Cost of Living Crisis and save money via her Instagram account A Money Minded Mum . Most importantly she has focussed hard on her goals from a very young age. From growing up in a very modest family, to being mortgage free by 33, she sat down with MoneyMagpie to tell us her very inspiring story.

Hannah Pears: My plan is to be mortgage-free by 33. I have always been interested in houses. This desire sprung from being a creative person and from a young age I wanted to be an interior designer, therefore getting my own home was crucial to me.

HP: I was 22 and on my own when I purchased my first home. My forever home was purchased last year at the age of 30 with my partner.

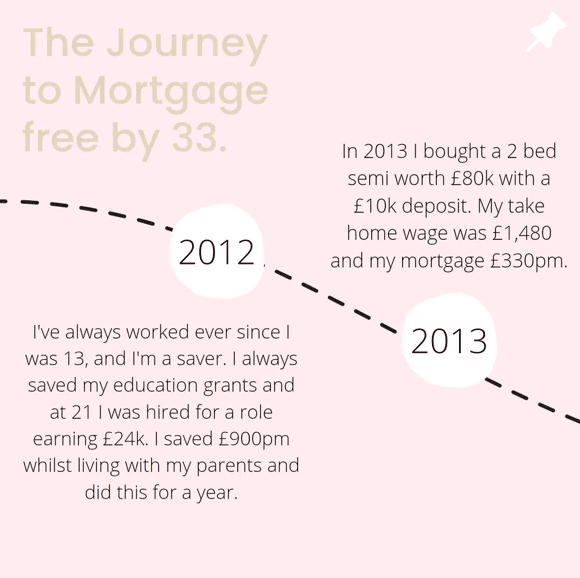

HP: Back in 2013 my initial deposit was £10k for a two bed semi worth £80,000. This deposit had come from prior savings as I’d worked since I was 13 and all throughout University. I got my first role straight out of graduation in August 2012 and was able to save £900pm, in mid-2013 I bought my first home.

Fast forward to 2021 and a meshing of lives between me and my partner, one house being completely renovated and both our properties going up in price we sold our homes and pooled our funds to equal £130k in equity. We had a further £70k in savings. My partner having £50k built up since 2010 and myself £30k built back up since 2013. Our deposit was now £200k.

HP: We have a very specialist type of mortgage. Our £200k bought our home but it left us very little else to do up the house which needed a full new kitchen and plumbing. The mortgage we have allowed us to borrow £20k but the loan to value ratio is essentially not there as we do own our full home. This enables us to access a very cheap rate when the base rate was as it lowest.

The bank came back out to revalue the property after renovations and ensure their loan has increased the value added to the home for payback purposes. The property is now valued at £275k.

HP: The loan is short-term, we only ever had three years to clear it, but we will do it in two and a half years. We pay back £800pm. We also paid back £2,000 right away as the solicitors didn’t need as much money as anticipated, and the kitchen we installed was cheaper than predicted.

HP: Oh yes, we’ve been in the house since April 2021 and I only bought curtains yesterday. There aren’t any luxuries and we live very carefully in our means. Right now, we don’t get weekends away, new clothes, expensive days out and so forth but we will eventually. This is allowing us to build up an emergency fund at the same time as pay back our mortgage. We have £8,400 left to pay back.

HP: We are both in full time employment. I work in management in the education sector and my partner is a self-employed builder.

HP: Currently our combined income sees 29% go towards mortgage payments. In about 16 months’ time this will drop to 0%.

HP: We have never rented properly though I did at university. After university, at 21 I moved in with my parents for about ten months whilst I saved my deposit and my partner didn’t leave home till 29. This was not ideal for him but he wanted to save for a deposit rather than rent and, luckily, he has the means, through family, to do this.

HP: I feel like I almost can’t comment having never rented properly and I don’t wish to seem not genuine. As we face the Cost of Living crisis, I imagine it’ll be harder than ever. Budgeting has helped us massively with saving for property: for my partner it meant being part of the boomerang generation and staying with this mum well into adulthood.

For me, it meant aiming towards buying cheap housing, in potentially not the nicest area, just to get a start. We live in the north and property is cheaper. We make use of sinking funds to budget towards goals and always have an eye on the bank accounts, I check them daily out of habit.

HP: We are on track to be mortgage-free by the time I am 32 and 6 months, my partner will be 41 years old.

HP: I am unsure. My partner being a builder does have a desire to as he could work on any issues in the property for the tenant but for now we are happy just being mortgage free ourselves. We also don’t wish to add to the rental crisis and lack of affordable housing for young people so we would want to consider this carefully.

HP: Security and need. When we came to buying the forever home, we struggled to buy: the market was crazy and we had two other houses fall through, which left us devastated. For these, we were looking at £300K homes with traditional mortgages, so we regrouped and went into it differently. We prioritised our real key needs for a home and, instead of the extras, we went for the basics and decided to spend the time renovating ourselves.

HP: My mum. She is frugal through and through. Her parents were from generational poverty and despite my mum achieving some social mobility her upbringing stayed with her. I have furthered the social mobility and her life lessons stay with me too. Don’t touch what you can’t afford she would say, and she meant it, there was not a credit card in that house.

That’s not to say at times we didn’t struggle, there was two occasions in my childhood we needed a foodbank but she was scrupulous about debt. I now give back from my wages each month to the Trussell Trust.

MoneyMagpies guide to saving for a mortgage here.