Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Don’t you wish you could detox your finances and still enjoy a treat or two?

Ohhh, imagine the bliss of being able to get through your days without worries about money.

Who hasn’t wanted to be able to do all their food shopping in Marks and Spencers or open every credit card bill and bank statement without feeling a pit in their stomach?

The fact is most of us believe that having more money would make our lives a whole lot better in nearly every way. But that’s not necessarily true.

Follow our two day financial detox guide below and find out how take action to sort out your financial worries, and then sit back relax and treat yourself once you’re done. With summer around the corner, now is a great time to detox and pamper yourself all at the same time!

Our burning desire to own the latest iPod or kit our kids out in Boden isn’t all our own fault. In fact according to psychologist Carol Martin-Perry we simply wouldn’t be human if we didn’t want more. So unconsciously we like to reward ourselves for simply getting though the day, and spending money on nice things is of course the most obvious way of rewarding ourselves.

Our burning desire to own the latest iPod or kit our kids out in Boden isn’t all our own fault. In fact according to psychologist Carol Martin-Perry we simply wouldn’t be human if we didn’t want more. So unconsciously we like to reward ourselves for simply getting though the day, and spending money on nice things is of course the most obvious way of rewarding ourselves.

There’s also no point of aspiring to have all the things a celebrity has and living a flash lifestyle as the reality is celebrities get loads of things for free and don’t get charged astronomical prices like most of us. Not only that, but most of them are not happy, as a quick perusal of Heat or the Daily Mail online will show you!

Take note – being rich is not about always having loads of cash, it’s about learning to live with what you have and making the most of it. Not everyone who has loads of money is happy.

Most of the time the happiest people are those who are able to live within their means. These people can treat themselves without feeling guilty because they know they can afford to.

We’re going to show you how you can pamper yourself and detox at the same time too.

First let’s talk about detoxing…

This is a detox with a difference, it’s not about giving up caffeine or alcohol (although we recommend both of those!) and you’ll actually add a few pounds (the money kind of course) too.

A lot of people are so afraid of looking at their bank balance they build up their financial situation into the worst possible scenario. Your finances a might be in better shape that you think, the only way to face it is head on.

build up their financial situation into the worst possible scenario. Your finances a might be in better shape that you think, the only way to face it is head on.

The most painless way, without looking at your bank statements, is check your financial fitness online. The Money Advice Service’s website has a free monthly money healthcheck service which sends you advice plans and tips on how to take action today.The free service finds out which areas you need to focus on and provides practical ways to improve your situation.

TO DO: When you’re ultra busy it can be tough to remember what bills to pay back on time. Some people get into debt simply because they are too busy to check their bank balance. Many banks now send you text alerts when you’re at or near your overdraft limit or if you’re about to go overdrawn. This is just one of the useful automated services you could use to check things. Also get into online banking and mobile banking so that you can check your incomings and outgoings any time of the week. It will also enable you to see if anyone is taking money from you fraudulently.

See our article on detoxing your finances for more ultra healthy financial habits

Okay, we lied a little about the detox bit, but only slightly. Don’t underestimate the impact of your health on your finances. Juicing and giving up caffeine may not make you rich but eating regularly, taking a bit of exercise, cutting right down on alcohol and sleeping well, can help keep your finances in the black.

Okay, we lied a little about the detox bit, but only slightly. Don’t underestimate the impact of your health on your finances. Juicing and giving up caffeine may not make you rich but eating regularly, taking a bit of exercise, cutting right down on alcohol and sleeping well, can help keep your finances in the black.

Taking care of yourself on a basic level is important to all areas of your life and your finances are no exception. When you feel good you make better, healthier decisions all round.

TO DO: If you’re a breakfast skipper, think baby steps, just having a banana in the morning will regulate blood sugar levels. Never go clothes shopping on an empty stomach either. You don’t have to be a five times a week gym bunny to benefit from exercise – put up the music and dance for 10 minutes a day, or go running or walking and enjoy the fresh air.

Learn to love your bills, that’s right, learn to love those brown envelopes. Marianne Kelly, a 38 year-old software developer from Brighton says managing money should start with a look at your bank statements.

Learn to love your bills, that’s right, learn to love those brown envelopes. Marianne Kelly, a 38 year-old software developer from Brighton says managing money should start with a look at your bank statements.

“I make a point of opening every bill and statement as I get them. It hasn’t always been easy but if you get into a habit of simply checking your balance every few days you end up subconsciously totting up what you are spending. Not looking at how much money you have seems totally crazy to me now.”

The awareness of how much money you have can make such a big deal.

TO DO: Now, with the help of a friend if you need, pick up just one unopened bill you may have. You don’t have to open all of them at once. Start with something small. Also look at our article on how to Spring Clean your finances and get in order for some great advice on taking control.

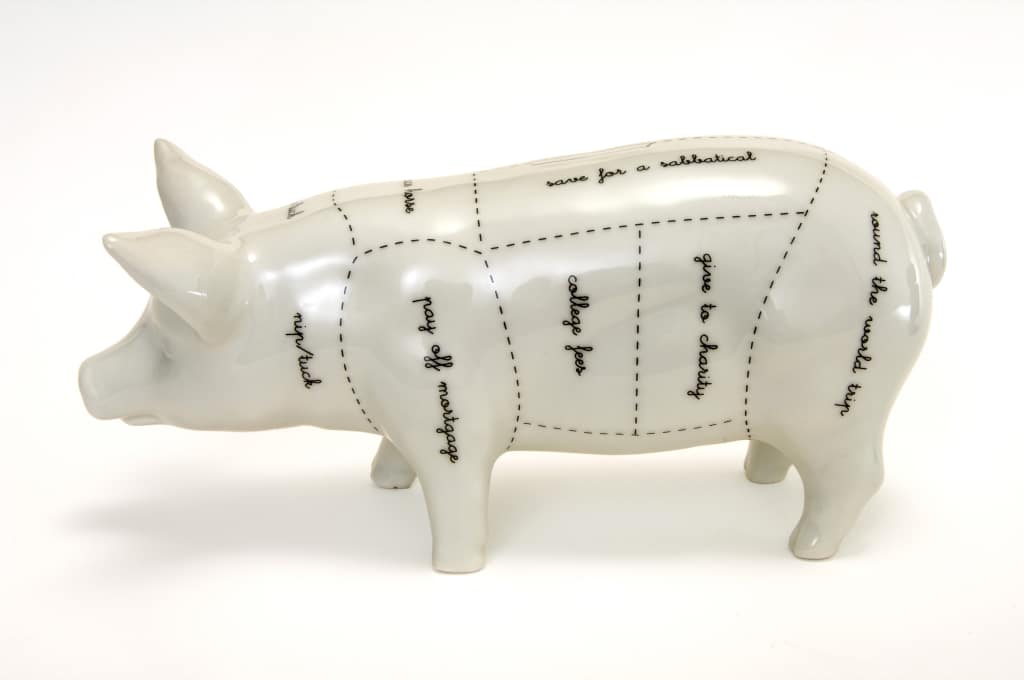

It’s as simple as totting up your outgoings and earnings. It’s so important to have some kind of budget. Basically a maximum of a third of your income should go in paying debt. All budgets have to allow some kind of room for maneavour and that includes treats too.

It’s as simple as totting up your outgoings and earnings. It’s so important to have some kind of budget. Basically a maximum of a third of your income should go in paying debt. All budgets have to allow some kind of room for maneavour and that includes treats too.

Keeping a spending diary is an excellent way of getting a snapshot of your daily outgoings and seeing where your money’s really going each month. It’s easy enough to do – all you need is a notepad and pen – draw out two columns, one for incomings and one for outgoings.

Once you’re done, add it all up and you’ll have an estimate on your monthly outgoings and incomings. If you earn more than you spend – congratulations!

If you spend more than you earn, don’t worry, you’re not alone! Now you need to sit down and think about where you can make some serious savings. Check your regular direct debits and cancel any that aren’t necessary. Make a realistic budget for extras like shopping trips, going to the cinema and eating out.

TO DO: For household finances you should have two bank accounts, one for all your household bills and your mortgage and another for more spontaneous purchases. Out of your second account allocate yourself some treat money.

Lecture over, now you’ve got to start planning for the future, because if you do want more money, lots more money, the only way it’s going to happen is if you have goals.

Lecture over, now you’ve got to start planning for the future, because if you do want more money, lots more money, the only way it’s going to happen is if you have goals.

About 50% of what you’re doing now should reflect your longer term goals.

Do you really want a lifestyle that is just about spending money. Having material things will not make you happy long term, happiness comes in all shapes and sizes but if that’s what you want you need to think about how to make it happen.

Of course this may mean starting your own business, becoming your own boss, starting a shop online, turning your hobby into a job or simply getting rid of your unwanted junk. People who make serious money are their own bosses, think of Alan Sugar, Stella McCartney or Madonna.

TO DO: Think of what you are really good at, and what you love doing. The best jobs are those we enjoy, but don’t expect it to be easy. People who do earn lots of money are often incredibly driven and for them it may not be about money. Lots of pop stars simply want to be loved and that’s what drives them.

Take a look at our budget planning section to get a lot of ideas and advice on how to come up with, and meet, long-term goals.

We know it may sound boring but money management really can be fun. If you want to treat yourself you’ll have to figure out places in your life where you can save, pull back and generally cut out (if possible). For example do you really need that £2.50 morning coffee? Or can you pick up free magazines instead of expensive copies of Vogue or GQ?

It’s the little things that will make a big difference and then you’ll have more money for big treats once in a while.

There is big money to be saved from group discounts and simply buying in bulk. Buying in bulk also means you can treat yourself to the best brands when they are on sale or offer good discounts and store them away. Buying in bulk or group discounts can be done with many things such as:

Take a look at our article on the benefits of bulk buying for more information on how to save money in groups.

Another way to get the best luxury lifestyle for less is to try house swapping. An increasingly popular and easy way to take a holiday is to swap homes with other families in the UK and abroad. Go to a house swapping agency such as Lovehomeswap. Sign up online and see where in the world you want to go.

Another way to get the best luxury lifestyle for less is to try house swapping. An increasingly popular and easy way to take a holiday is to swap homes with other families in the UK and abroad. Go to a house swapping agency such as Lovehomeswap. Sign up online and see where in the world you want to go.

No money changes hands. You can even swap cars and some are happy to look after others’ pets. Remember though that house swapping doesn’t equal a free holiday. You’ll still have to pay for flights and all the other usual holiday costs such as food, entry to museums etc. But of course the big cost – accommodation – will be free.

If you really want to go all out and pamper yourself why not book yourself into a spa for a couple of days. Websites like Groupon, Go Groopie and Mighty Deals always have good group offers for really cheap.

Do something fun that doesn’t cost money – take your relatives on a nice day out rather than spending lots of money on unwanted presents, do something that will touch them but that doesn’t cost the earth.

You could also try having a zero-spend day once a week. Use your local library for books, magazines, music and film. Use your points to buy things such as Boots or Superdrug cards for toiletries, Tesco Clubcard for dinners in restaurants and Avios for a trip to a theme park.

Use food you have already in the kitchen to make a picnic and have a family outing in the park for free. Find out how to live for free on loyalty and reward cards.

Cut costs by buying your beauty bits with discount websites. You can save you money, time and effort on skincare, haircare and perfume if you know where to look.

LookFantastic sells pretty much everything beauty related you can imagine and all at great prices. Expect to save at least 15% on RRPs. And, not to be left out, the men can get their grooming bargains from here too with free worldwide delivery.

LookFantastic sells pretty much everything beauty related you can imagine and all at great prices. Expect to save at least 15% on RRPs. And, not to be left out, the men can get their grooming bargains from here too with free worldwide delivery.

Head to the Boots special offers section and check out their three for two offers, which are quite often on their ever-popular No7 range. They also have half price products, buy one get one free and even free gifts with certain purchases.

You might also be interested in reading – Top ten money-saving beauty websites.

Here at MoneyMagpie we’re always on the lookout for a good freebie. Sign up to our freebies newsletter to get freebies delivered to your inbox every week.

Don’t turn your nose up at competitions! We know it might seem unlikely that you’ll win, but your chances of success are usually a lot better than you think. Why? For the simple reason that people rarely bother to enter competitions because they think they have no chance of winning. This opens the doors for clever MoneyMagpies to swoop in and claim all the big prizes. Why not give them a go and then check out our article on how to make money from competitions?

. .

If you want more free stuff we have an article on 50 ways to live for free or free city living.

Basically it’s not rocket science but we’re bad at looking after our money because it’s generally seen as not fun. But actually, once you get into it, it can be fun! Yes really.

If you give yourself the task of beating the system, getting things for free or cheap or even doing without things that the shops are desperate to sell you, it becomes a game. You’re sticking it to the man. Once you get that frame of mind, the rest is easy!

Make a new year resolution to take control of your finances – sign up to our debt action plan emails, do a financial health check and change your spending habits. Once you regain control and make it fun, you will find it much easier to keep on top of your finances.

Mine is to have another child!!

It’s not really a New Years resolution but I am going to try and take control of my finances..I’m doing it the old fashioned way by writing down outgoings. Think it’s psychology makes you think twice, same for extra income

New Years Resolution is to try and be more positive, healthy and happy and not get weighed down by the little, unimportant things

Learn to drive

Avoiding debt of any sort is my tip. As one who had to use bancruptcy to start again the pleasure of knowing you will never be in debt again to anyone is powerful. Yes you sometimes have to do without a few things for a little while but you will afford the things that matter and avoid those that were just a debt laden impulse buy 🙂

I look at my outgoings at the start of each year so I know exactly how much I need to allocate each month. Having read through some of the excellent suggestions here I now firmly believe I can reduce this amount even more. Any extra savings I can make will go into my ‘windfall’ fund for Christmas 2015.

My resolution is to meal plan – have not been successful at this in the past, so will be looking online for some inspiration – Hopefully by the end of February I will have got through some of the “bargains” BOGOF items I have bought in the past

Also going to use those samples I have had of beauty products, maybe plan an evening each week of pampering using some of them

to avoid getting stressed, particularly at work and to not take too much on, i need to be more assertive and just say ‘no’

This year I will make a budget and stick to eat

New year is a good time to look at finances. People are often short of cash after Christmas, so there is a genuine need to cut back.