Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

This is a paid article on behalf of JamDoughnut

JamDoughnut is a cashback app with a difference. A difference that can make a big impact on your bank balance.

Cashback sites are familiar to lots of us now, in fact so much so there’s an almost overwhelming amount to choose from. They all do what they say on the tin. They reward users with cash for doing their shopping or paying for services via the cashback site or app (often by using a referral link). But, usually we have to wait days or weeks (sometimes even months), to get our rewards.

With JamDoughnut you get your cash instantly – literally as soon as you confirm your purchase.

How great is that? Here at MoneyMagpie we were so impressed that we decided to try it out for ourselves.

Unlike other cashback sites or referral apps, JamDoughnut gives you cashback when you buy a gift card or gift certificate for the shop or service you want to buy from. So, rather than using your debit or credit card, you buy a gift card and use that to complete your purchase. (There are 100s of brands to choose from.)

You can use your gift card in app, online or on the high street. You can also share or gift your gift card to someone else. (An important point however is that the gift cards are non-refundable so be sure before you purchase.)

Every time you buy a gift card you earn points which are converted into cash. These points are collected in your JamDoughnut Jar (your wallet).

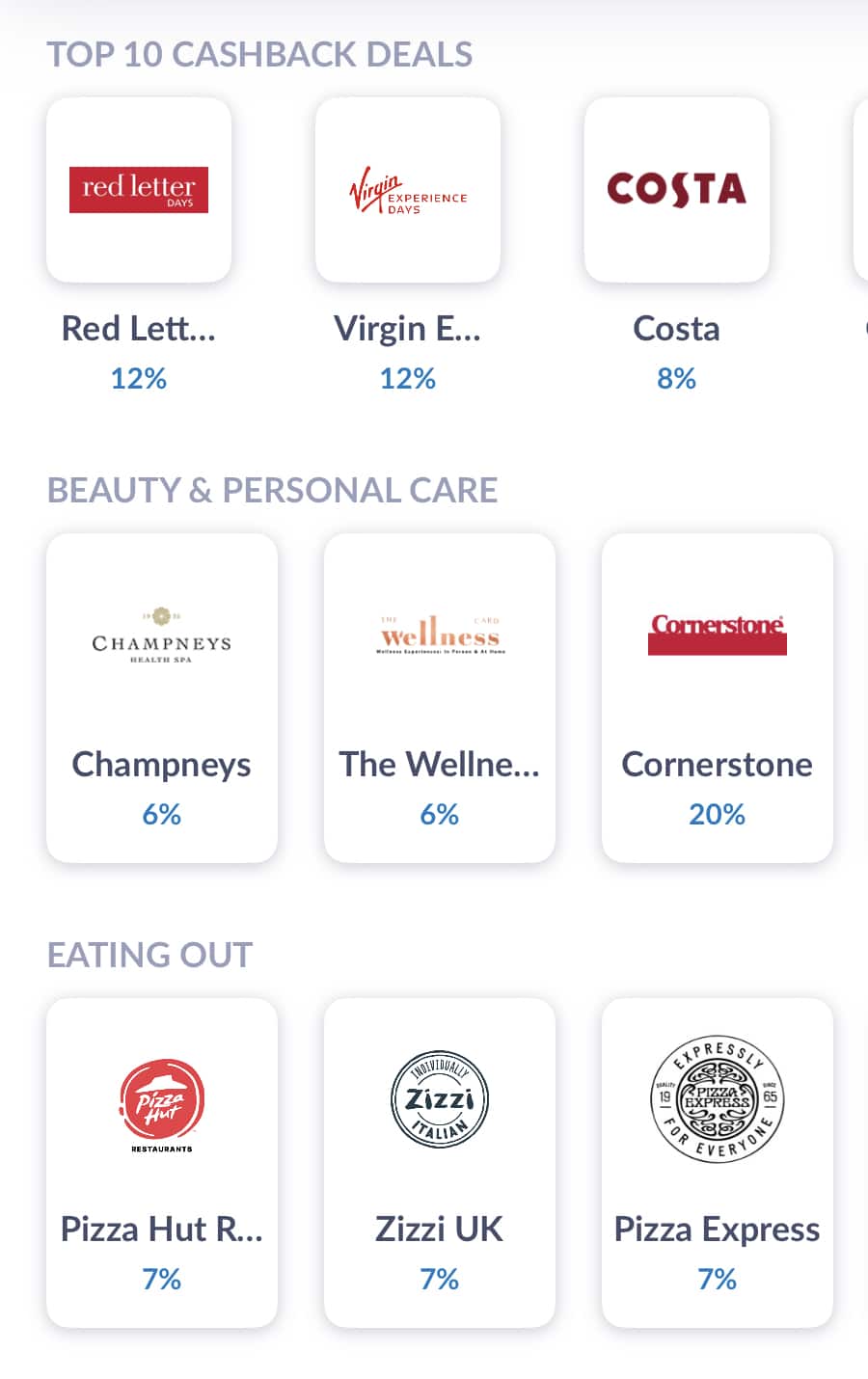

The amount of points you can earn is different for each brand or shop. It can range from 3% – 20%. On average it’s around 7-8% of your total purchase. You can see exactly what percentage you can earn underneath the icon for each brand.

You can shop at popular brands like Morrisons, Boots, Currys and Airbnb!

Your JamDoughnut wallet is also called a Jar. Once you get to £10 or over, you can withdraw the money from your wallet. It even tells you how many more points you need to earn in order to get to the £10, which is a good incentive to keep using the app.

It really is that simple! Buy your gift cards, earn points instantly, withdraw your cash (£10 or over) from your wallet whenever you want.

Our intrepid shopper, Rach, gave it a go.

“The app is available on iOS and Android. I have an Apple phone so I searched for JamDoughnut on the app store, found it with no problem and downloaded it.

Next you have to register. This took less than a minute. There was no need for a password, I simply clicked on a link they sent to my email and the same to my mobile number

I was then taken to a page that showed me all of the available shops and restaurants etc. There are so many to choose from! It helps that they are in categories such as: Health & Fitness; Home & Garden; Shopping & Fashion; Takeaway; Travel & Holiday.

I’ve recently moved house so I tapped on “Home & Garden”. The app lists all sorts of shops and websites – from Bloom & Wild, B&M, B&Q, Ikea and Wayfair (to name just a few).

As I was scrolling I remembered that it’s Mother’s Day on Sunday so I thought I’d try out Bloom & Wild. The first thing that caught my attention was that as it was my first purchase I immediately earned a bonus in the form of an additional or free 200 points which meant £2 was added to my wallet.

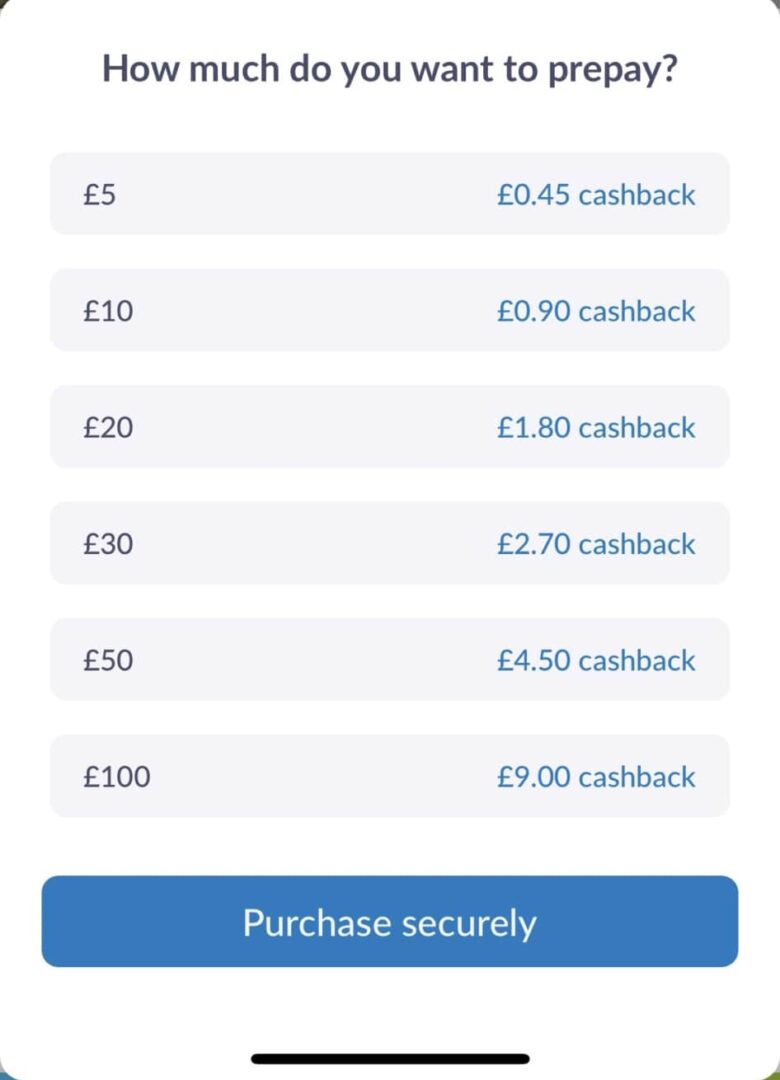

The instructions are clear and simple. Tap on “Purchase Securely”, enter the amount I wanted to spend, then once my payment was completed I was sent a code to use online at the Bloom & Wild checkout. The app also explained that anything I didn’t spend would remain available to spend at a later date.

I paid for my gift card using my bank account which was a simple click through then confirm. One thing to note though, is that you get less cash back – up to 50% less – if you purchase via apple pay rather than using your bank account.

Lastly, in bold letter it told me that my cashback would be added immediately to my JamDoughnut Jar or wallet. It also clarified that I could use other vouchers and or loyalty codes with my JamDoughnut code to maximise savings and discounts.

All in all – very straightforward. I was impressed! What I particularly liked was that when I clicked on ‘purchase securely’ the app told me exactly how much I would earn back on each amount available to spend on the gift card.

I don’t really use other cashback sites as I tend to forget they are there but I will definitely be using JamDoughnut again.”

We think this is a brilliant take on an established method of earning money when shopping. Quite often we hear of people who have signed up to cashback sites but have to wait a ridiculous amount of time to reap the rewards. With JamDoughnut you don’t have to wait or remember that you’re owed a certain amount and then waste time chasing it up or constantly checking to see if it’s arrived in your account.

There is a really good range of popular high street shops, restaurants and bars to choose from.

As our shopper found, it’s incredibly straightforward to use. We also took a look at their reviews on TrustPilot and they score a very impressive 4.8 out of 5 and 93% of users rated it 5 stars.

We also found that their refund policy was better than the purchase of a gift card so even you are buying as a present or cash back you have better protection than and this is shown by their reviews on TrustPilot that we have read.

Lastly, we think this could also be a fantastic way to budget. You could buy a gift card for Asda, for example, for £30 and that’s your shopping budget right there. Not only does it help you stick to your allowance, you get paid to do so! (An Asda gift card gives you 3.4%, which is £1.02 for £30).

Click here for more information on the app and how to download it to your phone.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.