Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

UK inflation falls

UK inflation fell to 8.7% in the year to April, new figures show. This is down from 10.1% in March, reaching single figures for the first time in eight months. Although this has come as a relief for many, inflation is still slightly about the 8.2% figure forecast previously.

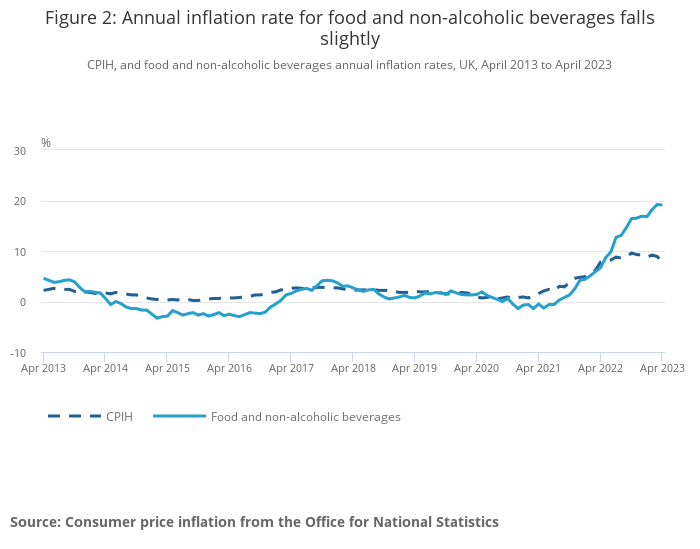

However, due to food prices in the UK continuing to soar at the fastest rate for 45 years, inflation is falling more slowly than analysts expected. Currently standing at 19.1%, food inflation is close to breaking records for the speed at which it is rising.

Inflation lowering is good news. However, it does not mean prices are declining – it simply means the rate at which prices are rising is slowing. Inflation measures the speed at which costs go up – not the costs themselves. It may take a few months for lower prices to be reflected on supermarket shelves.

According to the data from the Office for National Statistics (ONS), although vegetables such as potatoes are more expensive than this time last year, many staples have fallen in price. These include food shop regulars like bread, fish, cereal, eggs and milk.

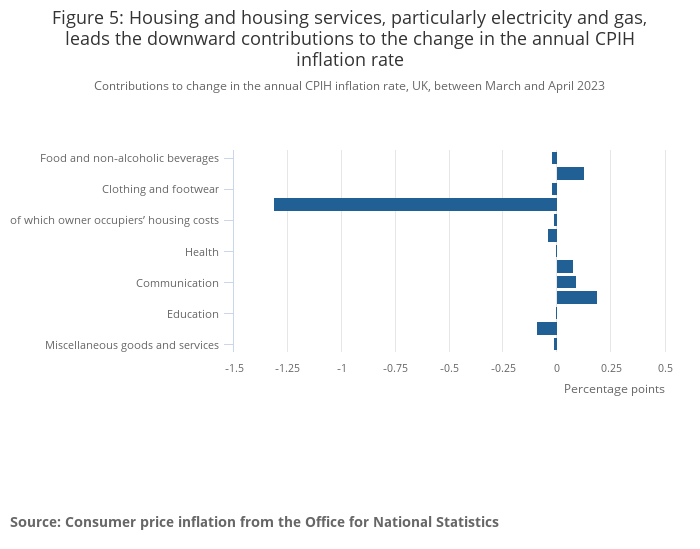

The cost of housing and housing services has slowed, contributing greatly to the decline in the inflation rate. Similarly, the price of gas and electricity have been a driving force in overall inflation dropping.

“Although it is positive that [inflation] is now in single digits food prices are still rising too fast. We must stick resolutely to the plan to get inflation down.”

“UK inflation is past its peak, but it is proving stickier and more embedded than expected. Rising levels of core and service sector inflation highlight the risk that domestic inflation pressures persist, even as the shock fades from high energy costs and other commodity prices.

“With growth holding up and recession fears easing, the scene is set for another interest rate rise next month, and perhaps at least one more before the end of the year.”

You can find the full release from the ONS here.