Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

In August, The Bank of England cut interest rates by 25 basis-points. What does this actually mean for you – and is it good, or bad? Our guest writer, Jordan Curry, spoke to experts to get a market reaction, and explain how your finances will be impacted by this change.

The Bank of England’s (BOE) Monetary Policy Committee (MPC) sets the base interest rate, which changes across the year based on factors such as inflation or deflation. Mortgage costs and savings rates are influenced by base rates, which can significantly affect investments. Markets expected a cut as did financial analysts. A second vote for MPC members to reach agreement was unprecedented.

On Thursday 7th August 2025, they eventually voted 5 to 4 in favour of a twenty-five basis point reduction. This means the 4.25% base rate came down to 4%. For anyone with ongoing commercial or personal debts, or large-scale borrowing, this was good news. Rising inflation elsewhere remains a concern for central bankers and financial analysts more widely.

Savers always lose out on a base rate reduction. Easy access accounts for smaller sums such as the market-leading Santander Edge Saver or Zopa Biscuit and cash ISAs outside of fixed interest deals, are often hit hardest. Advisors advocate that savers switch to higher paying accounts and low risk investment options for ‘Steady Eddie’ returns that can ride out varying interest rates and market instability.

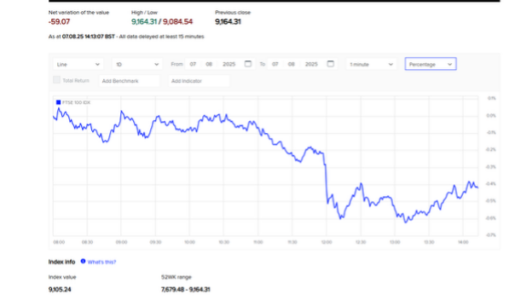

FTSE 100 screenshot after the announcement. A noticeable dip happens from 11:30am

Reuters confirmed a decline in the FTSE 100 of -0.7% before and after the announcement. It remained similar throughout that day. Come early afternoon trading on Monday 11th August, this figure was recovering

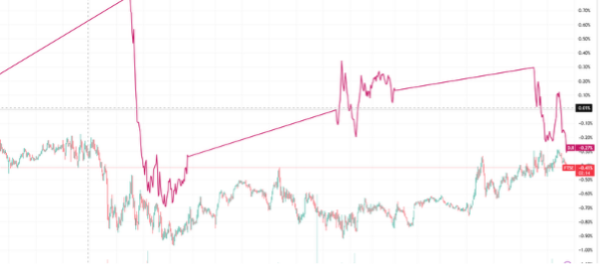

NASDAQ also performed well during early Thursday trading as did the NYSE by close of trading.

Globally, Thursday’s markets did little out of the ordinary, likely due to the anticipated rate cut compared to shock decisions which can rock markets.

The Dow Jones was the only other key market decline on Thursday 7th August, though external factors included anticipation of Donald Trump’s tariffs, a marginally worse than expected report on US employment figures, and commodity supply chains affected by the Ukraine conflict.

Declines in the FTSE 100 and Dow Jones though claims of direct correlation are significant exaggerations.

A long-time stock market investor told us:

“[The rate cut] shows that the Bank of England acknowledges financial headwinds they’re attempting to take action against. My investment decisions wouldn’t be affected currently, though if there was to be a further economic decline, I would reduce exposure to the UK stock market until conditions had stabilised.

I’m unsure how effective this approach can be as in my view, current inflation remains primarily driven by supply and energy costs, not through excessive demand.”

Trading View comparison of key global markets about two hours after the interest rate decision

Two financial service businesses also shared their perspective.

Laith Khalaf, Head of Investment Analysis at AJ Bell, said:

“An interest rate cut doesn’t help Rachel Reeves with the black hole in the country’s finances because it was already baked into the Office for Budget Responsibility’s (OBR) economic forecast in March. There’s now probably only one interest rate decision before the Budget where a cut could provide a windfall for the chancellor though markets expect rates to be held in September.

“This cut also won’t move fixed rate mortgages down that much, again because it was already baked into prices. If anything, today’s decision may push new fixed mortgage offers up a touch because so many of the rate-setting committee voted to keep rates on hold. Variable mortgages pegged to the base rate will of course fall on the back of this decision. With the base rate expected to be 3.5% by mid-next year, the outlook for mortgage borrowers is brighter.”

“The Bank of England thinks inflationary risks have picked up recently. Gradual and careful approach to interest rate cuts still prevail as a result. It will give markets pause for thought on how quickly interest rates will descend from here.” [Consumer Price Index (CPI) falling to 2% based on current medium term forecasts will reassure markets that existing predictions are largely accurate.]

Mr Khalaf then referenced pensions. “BOE forecasts predict that inflation will peak at 4% in September. A favourably timed spike for the calculation of next year’s state pension.”

No doubt this will raise questions about the triple lock, especially against a fiscal backdrop which suggests the chancellor is going to stick a shovel into taxpayers’ pockets for the autumn Budget.

Economic analysts at the bank stated: “We still think that the BoE will over-deliver relative to market expectations – but clearly, we need to see more evidence of disinflation.” Disinflation occurs when prices rise at slower rates.

Referencing inflation forecasts, HSBC said changes from the previous meeting appear to reflect:

Visit our Investments Pages for more market stories and investment information (not advice). You can also download our latest investing eBook: Investments with 10% Returns.